Ocean Freight Markets and Spreads

Ocean Freight Comments

The United States continues its vigilance to remove Houthi attack drones and missile assets from the Red Sea area. The goal remains to provide a safe and secure passage for global trade to move unhindered. There were no reported Houthi attacks this past week. Until the Red Sea is safe for vessels to transit, owners and operators are keeping to the longer routing around the Cape of Good Hope.

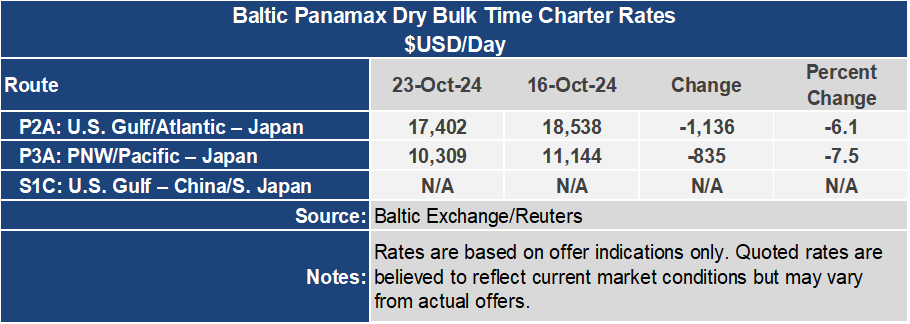

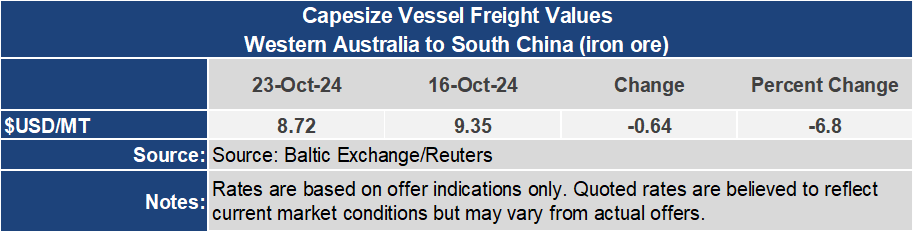

The Baltic indices continue their declines on soft demand and uncertainty with consumer appetites while fleet expansion continues. The Baltic Dry Index, the amalgamated measure of the dry bulk sector, ended the week down 13.8% or 231points to 1,445. This is the lowest level since early February of this year, and 21.1% below the index one year ago. The Capesize Baltic Index pulled the entire sector lower, dropping 24.7% or 631 points for the week to an index of 1,921. This has been its lowest level since early February and is 34.7% below the index one year ago. The Baltic Panamax Index lost 5.4% or 71 points this week to an index of 1,238. The BPI has been at the lowest level since August of 2023 while being 24.9% below the index one year ago. The Baltic Supramax Index was nominally lower.

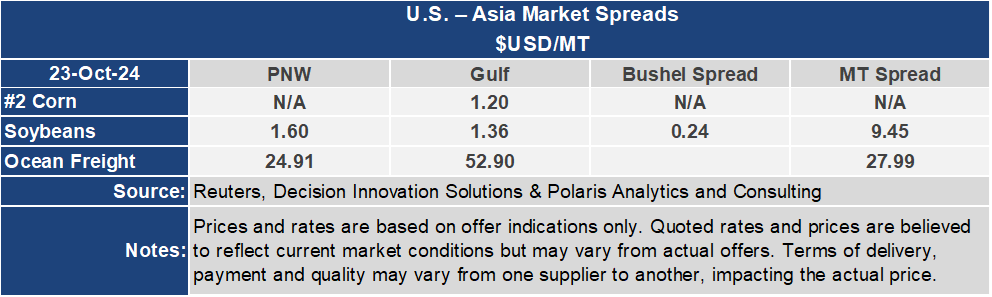

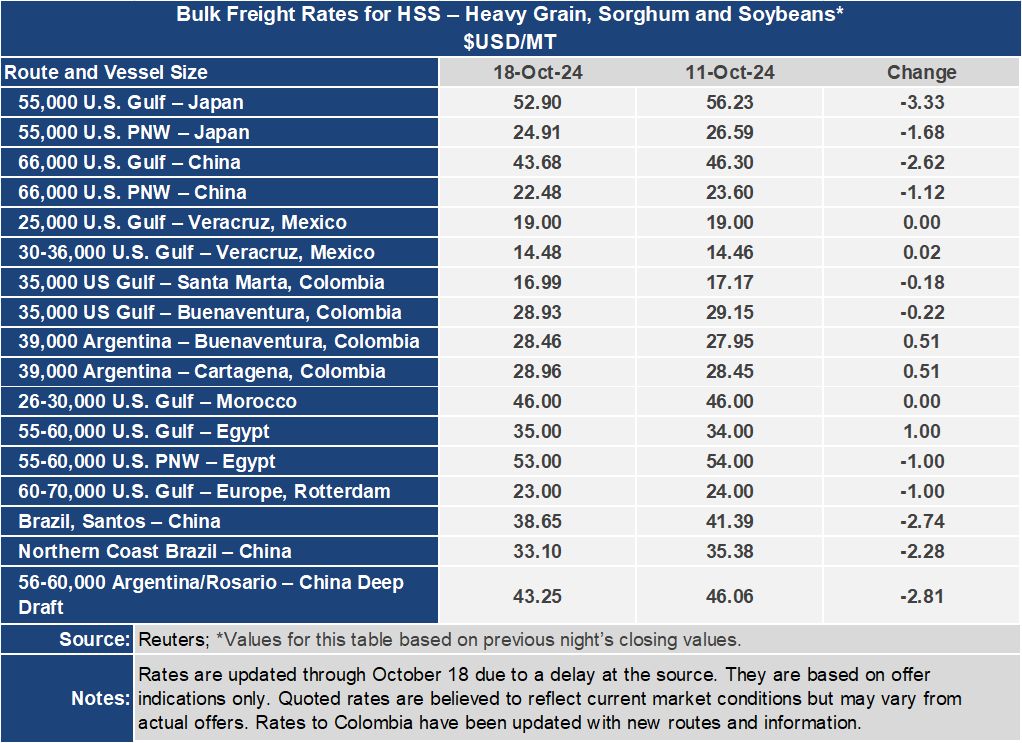

Voyage rates are available through October 18 this week due to a delay at the source. The weakness in the Baltic indices extended to the voyage market. The U.S. Gulf to Japan grain freight rate was down $3.33 per metric ton or 5.9% for the week ending October 18 to $52.90 per metric ton. From the Pacific Northwest the rate was down 6.3% or $1.68 per metric ton to $24.91 per metric ton. The spread between these key grain routes narrowed 5.6% or $1.65 per metric ton to $28.47 per metric ton. Both routes are quoted using vessels loaded with 55,000 metric tons.

To China the rate from the U.S. Gulf was $43.68 per metric ton for the week ending October 18, down $2.62 per metric ton or 5.7%. From the PNW, the rate was down $1.12 per metric ton or 4.7% to $22.48 per metric ton week ending October 18. The spread on this route narrowed by 6.6% or $1.50 per metric ton to $21.20 per metric ton. Both routes to China are quoted using vessels loaded with 66,000 metric tons.