Chicago Board of Trade Market News

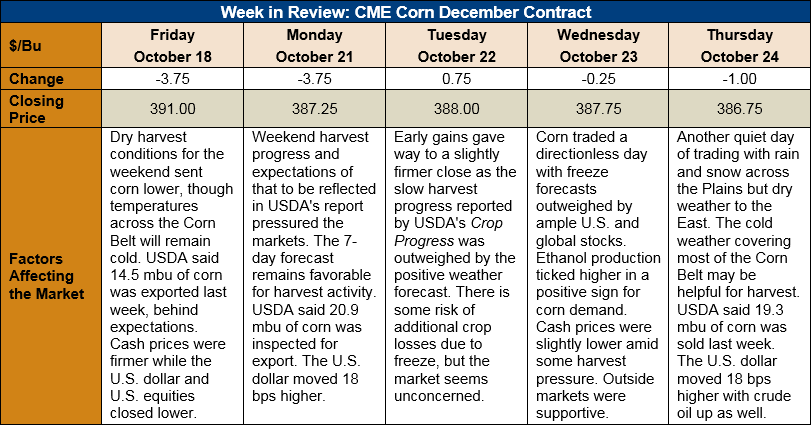

Outlook: December corn futures are 4 ¼ cents (1.1 percent) lower this week as the market continues to soften ahead of the U.S. corn harvest. The weather has been challenging for parts of the Midwest, while at the same time surprisingly favorable for others. The one thing for certain is that there are a wide range of estimates as to the size of the 2019 U.S. corn crop, given the year’s difficult weather.

For the coming week, the weather forecast is colder-than-normal for most of the U.S. Midwest with freeze warnings for the western Plains as far South as Texas. Despite showers across Texas, Oklahoma, and southern Kansas/Missouri, the seven-day forecast is mostly dry for most of the Corn Belt. The combination of cold but dry weather may actually help with harvesting fields that are ready. Late Monday, USDA said that 86 percent of U.S. corn is mature, down from the five-year average maturity percentage of 97 percent. The report also noted 30 percent of U.S. corn has been harvested, which is down from the average pace of 47 percent. Expectations are that the U.S. corn harvest could reach to 45 percent in next week’s report.

The weekly Export Sales report showed 491,500 MT of net sales with 489,000 MT of exports. The export figure was down 12 percent from the prior week and left YTD exports at 3.126 MMT, down 63 percent. USDA also noted 2,100 MT of sorghum was exported along with 900 MT of barley. Barley exports are up 7 percent YTD.

Cash corn prices are slightly lower this week with the average price across the U.S. reaching $145.53/MT. Basis has been slightly firmer despite the slow move lower in futures prices, averaging 17 cents under December futures this week. Basis in the Great Lakes region has been particularly firm this fall. Barge CIF NOLA values are 1 percent lower while FOB NOLA prices are slightly lower at $171.75/MT for October shipment.

From a technical standpoint, December corn is slowly moving sideways within its newly defined trading range. A break below the 20-day moving average earlier this week failed to create follow-through selling, helping create a neutral/sideways outlook. The market has resistance at $3.90 and the 200-day moving average ($4.01) above that, while minor support lies at $3.80 and major support at the 50-day moving average ($3.76). For now, the market seems content to chop sideways while waiting for fresh supply/demand news.