Chicago Board of Trade Market News

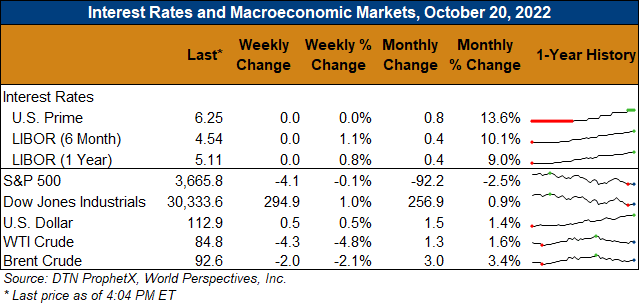

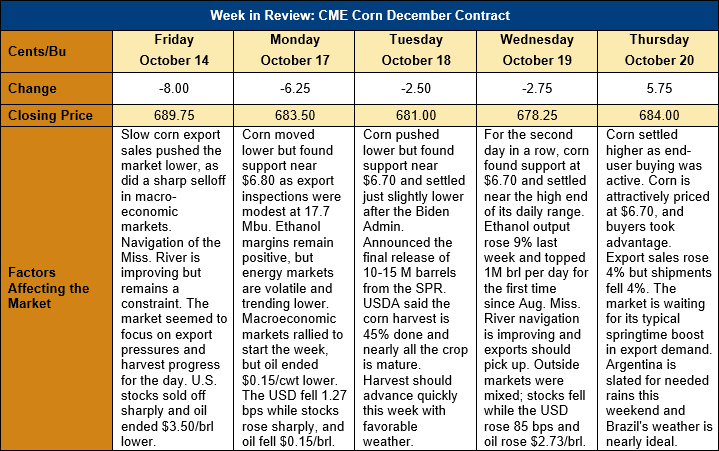

Outlook: December corn futures are 5 ¾ cents (0.8 percent) lower than last week after the market drifted lower for most of the week before it found some support on Thursday. The market has been increasingly focused on the U.S. harvest pace and the export prospects, both of which offered mild pressure this week. Grain markets are approaching the time of year when they typically make their seasonal lows and the fact the market has maintained a small, sideways trading range is indicative of underlying support.

The U.S. harvest is approaching its peak with favorable weather forecast for most of the Midwest. On Monday, USDA reported the 94 percent of the crop is mature and 45 percent is harvested, both figures are slightly above their 5-year averages. As the harvest advances, basis is starting to weaken slightly across the Midwest, with the Mississippi Rive navigation issues also working against basis levels. On average across the U.S., basis is 1 cent under December futures (-1Z), steady with the prior week and well above last year’s -18Z level. Basis in the Corn Belt is trading at a 10-year high this harvest season as feed and ethanol demand remain strong.

U.S. corn export sales were up 4 percent from the prior week and totaled 458 KMT for the week ending 13 October. Weekly exports were down 4 percent at 407 KMT and put YTD shipments at 3.076 MMT. YTD corn exports are down 31 percent and bookings are 52 percent lower, due partly to the strong U.S. dollar. Shipments are expected to follow their seasonal increase in the early spring, however, and most analysts expect the market will meet USDA’s current 57.788 MMT export forecast.

From a technical standpoint, December corn futures are now trading sideways in a range from $6.71 to $7.06 ½. Futures found support on dips to the low end of that range on Tuesday and Wednesday when commercial and end-user buying picked up. Amid the massive drought in Europe that will force the region to import more grain for feed and strong domestic livestock demand, corn futures seem likely to maintain their current support levels while waiting to start their seasonal, post-harvest grind higher.