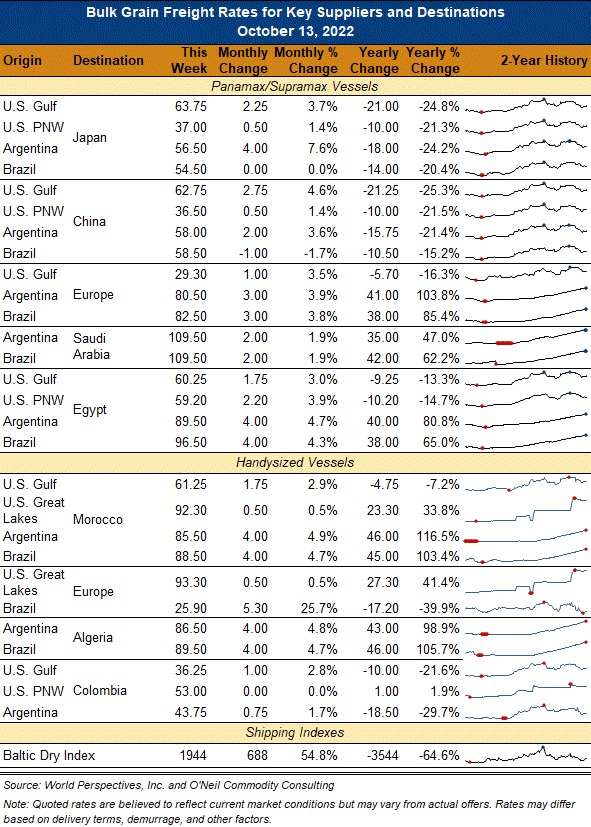

Ocean Freight Comments

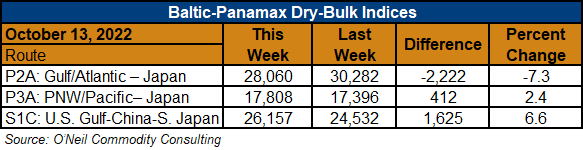

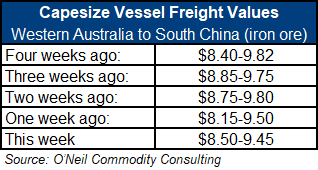

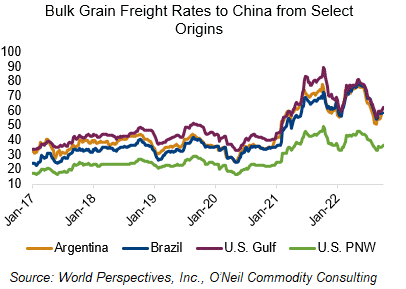

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: Physical dry-bulk traders got excited this week and took physical rates beyond what the Baltic Index would suggest is appropriate for an otherwise dull freight week. It could have been a case of traders wanting to cover shorts or was it just post-Golden Week holiday exuberance? Either way, things probably went a bit too far and that created some push back at week’s end. I cannot find a fundamental justification for the current rate jump, and we will have to see if next week brings cooler heads or more excitement.

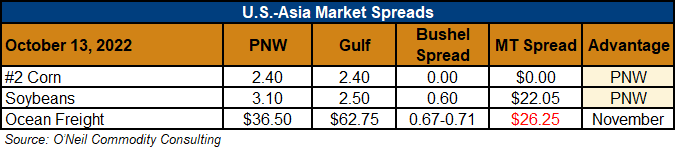

The low water situation on the Mississippi River and resulting barge restrictions continues to be the major story in U.S. transportation markets. Difficult river logistics and high barge freight costs are pushing U.S. corn and soybean exports to West Coast ports. PNW ports, however, do not have the capacity to absorb all the U.S. Gulf demand, which will quickly cause a crisis at both port ranges.

The U.S. railroad tentative labor contract has been voted on by union members, but full results will not be known until November 19 or later. I do not expect a U.S. rail strike to occur but am less confident about the situation with the ILWU union and West Coast Container ports.