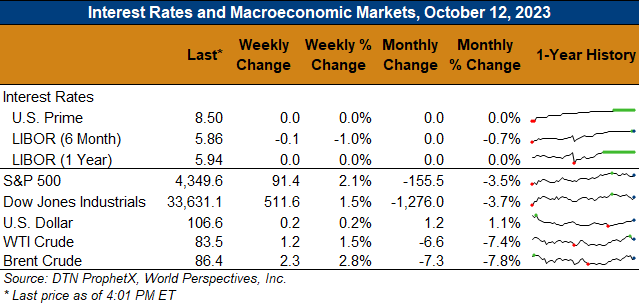

Chicago Board of Trade Market News

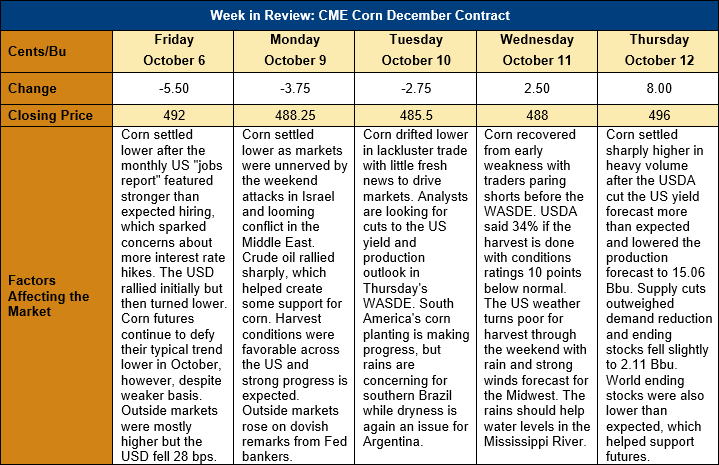

Outlook: Corn futures are 4 cents (0.8 percent) higher this week after sluggish early-week trade let values drift lower before Thursday’s WASDE-induced rally. The WASDE surprised markets as USDA cut the U.S. corn yield, production, and ending stocks outlook by more than analysts expected. Additionally, the agency lowered world corn supplies and ending stocks more than anticipated. The major implication of the October report is that U.S. and world corn supplies are tightening and the market is entering a more price-supportive environment.

The headline number from the October WASDE was the corn yield forecast, as pre-report expectations were widely varied with some analysts looking for increases while others predicted mild cuts. USDA forecast the 2023 U.S. corn yield at 10.86 MT/ha (173.0 BPA), down 0.5 percent from the September forecast. USDA did not adjust the harvested area forecast (though it could in coming reports) and the lower yield pulled 1.78 MMT (70 million bushels) off the 2023 production outlook. The U.S. is now projected to produce 382.65 MMT (15.064 billion bushels) in 2023, which would be up 9.8 percent from 2022.

On the demand side of the balance sheet, USDA lowered feed and residual use slightly and shaved 640 KMT (25 million bushels) off the export forecast, which now stands at 51.44 MMT (2.025 billion bushels). In total, the supply cuts were greater than the demand reduction, which left 2023/24 ending stocks of 53.62 MMT (2.111 billion bushels), which was 2.79 MMT (110 million bushels) below the September estimate. The ending stocks-to-use ratio now stands at 14.7 percent, down from the September estimate but the highest in four years. USDA raised its corn price outlook 1 percent to $194.87/MT ($4.95/bushel).

On the world balance sheet, USDA raised the production outlook fractionally as increases for Argentina, the EU, and Paraguay offset lower production in the U.S. USDA cut world beginning stocks and imports and increased the forecasts for feed and residual use and world exports. Total global corn consumption is pegged to increase 2.6 percent from 2022/23. World ending stocks were lowered 0.5 percent to 312.4 MMT for 2023/24, which leaves an ending stocks-to-use ratio of 22.5 percent, in-line with the past three years.

The weekly U.S. Export Sales report is delayed one day this week due to Monday’s U.S. Federal holiday, but the weekly Export Inspections report featured 550 KMT of shipments. That volume was down from the prior week, but YTD shipments stand at 3.24 MMT, up 14 percent. Sorghum export inspections were down 8 percent from the prior week at 56.7 KMT but YTD shipments are up 191 percent at 303.8 KMT.

On Tuesday, USDA said 89 percent of the 2023 U.S. corn crop is rated mature and 34 percent has been harvested so far. Both figures are slightly ahead of the five-year average while the conditions rating (53 percent good/excellent) is 7 percentage points below normal. The harvest will face some challenges this weekend as rains and strong winds are forecast for parts of the Midwest, but the weather outlook shifts back to dry and clear in the 6-14-day forecast. There is some frost/freeze risk for immature crops in the Northern Plains and Great Lakes states, but analysts and markets are showing little concern for now.

Technically, the corn market remains range-bound from support at $4.80 and resistance at $5.00 and is defying its normal seasonal pattern of early October declines. This year’s harvest lows look like they were made in September, and the market has embarked on its seasonal grind higher earlier than usual. The October WASDE prompted price action that formed a bullish outside day on the charts, which may prompt funds to lighten up on their large short position. Commercial traders are net long corn futures, which is often a bullish development.