Chicago Board of Trade Market News

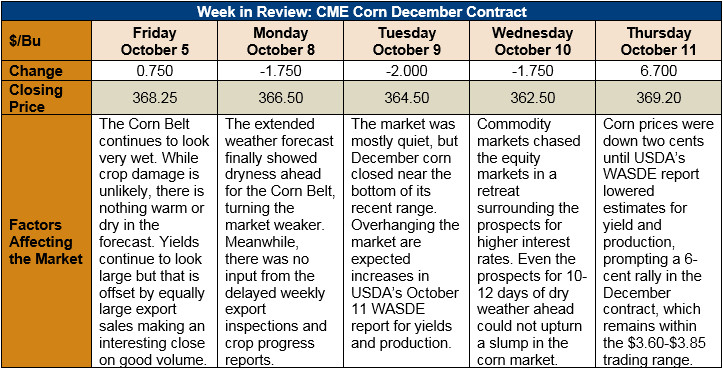

Outlook: Expectations were for a bearish WASDE report from USDA on Thursday – with increased yields, production and consequently ending stocks – has kept the market weak for much of the week. Ahead of USDA’s Thursday report, the December corn contract followed its previous days’ pattern by being down two cents on bearish expectations. USDA’s WASDE did not surprise on the supply side by raising its U.S. and world corn ending stocks estimates. However, it went the opposite of market expectations by lowering its forecast for 2018/19 U.S. average corn yield and final production. Yield was reduced 0.6 bushels per acre to 180.2, and that is before accounting for any losses from recent excessive wetness.

Much like U.S. stock exchanges, commodity markets had also reacted negatively this week to higher interest rates. It can be argued that the bullish stock market was due a correction, but commodity fundamentals were little changed. In fact, during the 2008 financial crisis there was a flow of capital out of stocks and into commodities.

The U.S. corn crop is 34 percent harvested (versus 26 percent on average), per the USDA’s crop condition report this week. However, that was only an 8 percent increase for the week as harvest progress was slowed due to persistent and heavy rains. The latest weather models show a 10- to 12-day dry period beginning 17-18 October that should enable a faster pace for the combines. Meanwhile, the report lowered the amount of corn in good/excellent condition to 68 percent from 69 percent a week earlier (64 percent one year ago). Condition ratings usually decline when the crop matures and dries down.

On the demand side, USDA/FGIS reported another big week of corn export inspections at 53.2 million bushels. That brings the total through 4 October to 228.6 million bushels, 62 percent more than at the same time last year. Farmers have been filling old corn crop sales but have been unwilling to make new ones at current prices. The result is that corn basis bids are inching higher, particularly at the Gulf where there is a steady parade of corn vessels to load. Finally, the goal announced this week of allowing E15 gasoline to be sold year-round should provide additional demand for U.S. corn in 2018/19.