Chicago Board of Trade Market News

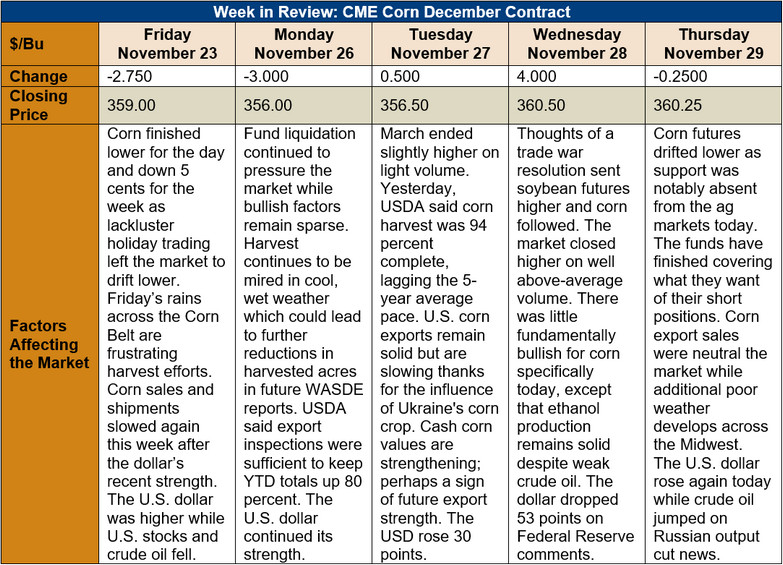

Outlook: December and March corn futures contracts continue to drift largely sideways amid a combination of fund liquidation and short-covering along with a lack of notable fundamental developments. December futures are down 1.5 cents/bushel from last Wednesday’s close, a drop of just 0.4 percent. Looking forward, the market is increasingly turning to a demand-focused model where exports, ethanol, and domestic feed use will be the predominant factors.

On the supply side, USDA said Monday that 94 percent of U.S. corn is harvested, slightly below the five-year average. The harvest has been complicated by rains and snow across most of the Midwest. The likely result of this dynamic is that the average U.S. yield and harvested acreage figure will be reduced in future WASDE reports.

The most readily observable demand component is the USDA’s weekly Export Sales report. This week’s data featured net sales of 1.26 MMT and exports of 1.05 MMT, which put YTD exports up 81 percent and YTD bookings (exports plus unshipped sales) up 16 percent. Sales have slowed in recent weeks, partly due to a stronger U.S. dollar, while exporters have been aggressive in shipping booked sales. Exports remain one of the strongly bullish factors for the corn market this year and are an increasingly important gauge of the market’s potential.

From a technical standpoint, March corn futures are oscillating between support at $3.65 and resistance at $3.85-3.90. The market is now turning higher within this range and is targeting moving-average resistance neat $3.80. The recent upturn has come with well above-average volume, which is a strong indicator the swing higher will likely be extended. If the market can sustain gains above $3.72 it would suggest the recent price softness was a bear trap, rather than fundamental weakness. The fundamentals are at least moderately bullish – especially with March corn near contract lows – and that combined with improving technical conditions suggest the market has room for further price appreciation.