Chicago Board of Trade Market News

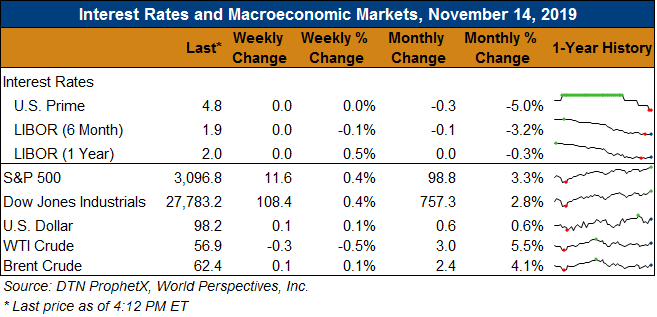

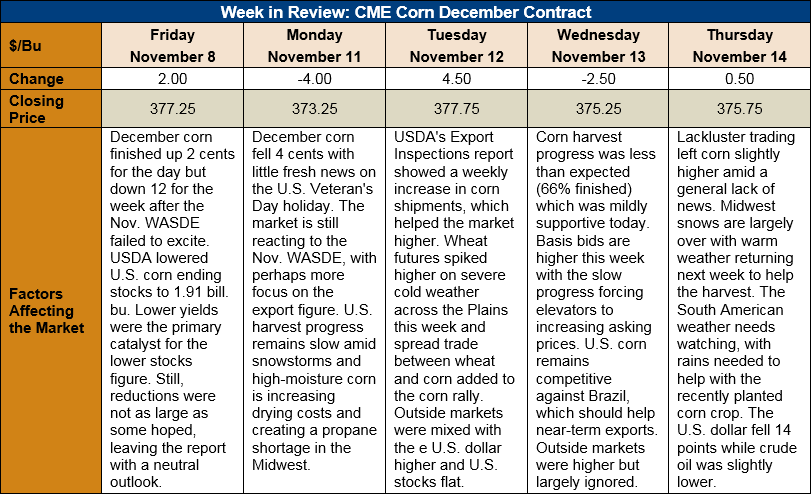

Outlook: December corn futures are 1.5 cents (0.4 percent) lower this week as the market remains largely range bound. The November WASDE offered comparatively few surprises, given the hugely abnormal U.S. growing season, and that has left markets mostly trading demand-side fundamentals.

The November WASDE delivered on analysts’ expectations for a lower U.S. 2019 corn yield figure, though USDA’s adjustment was modest. USDA pegged the yield at 10.488 MT/ha (167.0 BPA), a 1 percent reduction. That yield adjustment rolled down to lower production forecasts by 2.997 MMT (188 million bushels), putting the latest 2019/20 crop at 347.008 MMT (13.661 billion bushels). Both the yield and production estimates were within the range of pre-report guesses.

On the demand side, USDA lowered its expectations for U.S. feed and residual and ethanol corn use by 0.635 MMT (25 million bushels) each. USDA also lowered its export forecast by 1.27 MMT (50 million bushels) to 46.992 MMT (1.85 billion bushels).

Between the lower production figure and the consumption adjustments, USDA lowered 2019/20 ending stocks by 0.483 MMT (19 million bushels), leaving an ending stocks/use ratio of 13.7 percent. That comparatively minor adjustment to carry out left the market with neither bullish nor bearish information to trade. December futures initially moved higher after the report but finished the day only 2 cents higher than they they began.

USDA increased its expectations for 2019/20 U.S. sorghum production by 229,000 MT (9 million bushels) after increasing its yield forecast by 3 percent. USDA further increased the sorghum export forecast by 254,000 MT (10 million bushels), leaving a modest reduction in ending stocks. USDA left its price forecast unchanged.

Other WASDE highlights include USDA’s production estimate increases for Russia, Turkey, and several countries in Africa. The agency also lowered production forecasts for Mexico, Ukraine and the EU, with summer drought conditions hampering yields in the latter two countries. USDA also increased the export forecast for Brazil’s 2018/19 crop and Russia’s 2019/20 crop, given the strong pace of shipments in those countries so far. USDA is also expecting larger imports from Vietnam, South Korea, and Japan. In total, USDA lowered world corn production by 1.85 MMT and also reduced 2019/20 ending stocks by 6.59 MMT.

The weekly Export Sales report is delayed one day this week due to Monday’s Veteran’s Day holiday. However, the Export Inspections report (released on Tuesday) showed 560,000 MT of corn inspected for export last week. That figure was nearly double the prior week’s volume and put YTD inspections at 4.3 MMT (down 61 percent). Other highlights from the report were 25,000 MT of sorghum exports (YTD inspections up 134 percent) and 2,500 MT of barley inspections (YTD shipments are up 162 percent).

USDA noted on Tuesday that 66 percent of the U.S. corn crop has been harvested, below the typical progress of 85 percent complete. The weekly progress was lower than many analysts expected, with snowstorms across the upper Midwest slowing fieldwork. Reported progress in next week’s report could also be lower than expected as Minnesota, Wisconsin, and Michigan received additional snow this week. Looking forward, however, the weather is turning warmer for the Midwest through Thanksgiving.

Cash corn prices are slightly lower this week with the average price across the U.S. reaching $142.13/MT. Basis has been firmer, averaging 15 cents under December futures, as the slow harvest progress is pushing elevator bids higher in effort to secure grain. Barge CIF NOLA and FOB NOLA values are up from last week with FOB offers reaching $172.75/MT.

From a technical standpoint, December corn is range-bound and heading sideways with support at $3.72. This week, the 50-day MA has proven to be strong resistance while bears have been unable to push prices lower due to strong commercial pricing interest and firm basis levels. The direction of the futures market now largely depends on demand-side factors, especially exports, with seemingly few worries remaining about U.S. and world supplies.