Chicago Board of Trade Market News

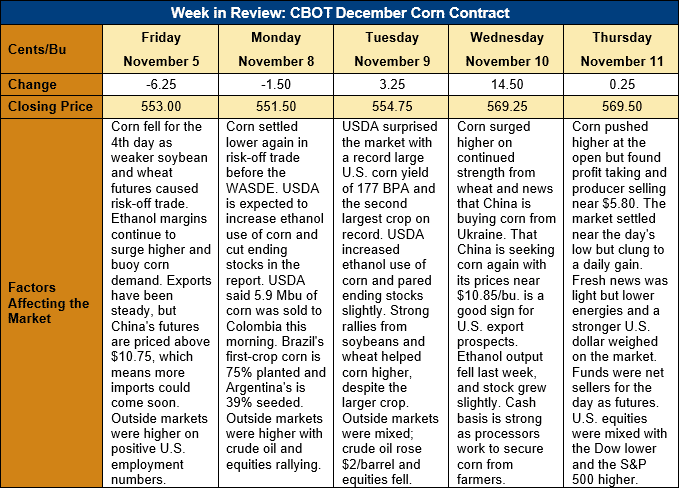

Outlook: December corn futures are 16.5 cents (3 percent) higher this week after the market sold off heading into the November WASDE report and rallied after its release. USDA gave a modest surprise to the corn market by increasing the U.S. 2021 yield to a record large 11.12 MT/ha (177.0 bushels/acre). Increases in domestic use, however, meant that 2021/22 ending stocks fell slightly. On the global scale, the two themes of USDA’s report were seemingly “big crops” and “big demand”, the latter of which should keep prices supported into the next marketing year.

Before the WASDE was released, analysts were expecting USDA to lower its corn yield forecast and increase the soybean yield estimate, but the agency did the opposite. The record 2021 U.S. corn yield was due, in part, to large increases for Minnesota and Michigan, while soybean yields were lowered due to below-expected yields in the eastern Corn Belt. USDA’s data was bullish soybeans and the ensuing rally in that market helped pull corn futures higher, despite record corn yields.

USDA’s yield adjustments pushed the U.S. 2021 corn crop to 382.6 MMT (15.062 billion bushels), up 1.092 MMT (43 million bushels) from the October estimate. The new production estimate is the second largest on record (behind the 2016/17 crop) and is 24.16 MMT (951 million bushels) larger than the 2020/21 U.S. crop.

USDA made relatively few changes to the demand side of the U.S. 2021/22 corn balance sheet. The agency increased corn used for ethanol by 1.27 MMT (50 million bushels) due to the strong production pace so far this year and rising profit margins. USDA lefts its export and feed and residual use forecasts unchanged from the October report. In total, the ethanol use increase offset larger yields and U.S. ending stocks fell 0.178 MMT (7 million bushels) to 37.924 MMT (1.493 billion bushels). The ending stocks-to-use ratio was essentially unchanged, and USDA kept its average farm price forecast at $5.45/bushel.

Outside the U.S., USDA increased world corn production by 6.4 MMT due to larger crops in the U.S, Europe, and Argentina. USDA increased Argentina’s 2021/22 corn crop (which is 39 percent seeded so far) by 1.5 MMT to 54.5 MMT. If realized, that would be a record large crop for the country and coincide with a record large Brazilian crop (projected at 118 MMT).

USDA also increased the outlook for global corn use and raised feed use 1.1 MMT and world trade by 1.6 MMT. World corn ending stocks for 2021/22 are forecast at 304.4 MMT, up 2.7 MMT from October and 12.5 MMT above 2020/21 levels. The world ending stocks-to-use ratio, however, is steady with last year at 22.1 percent. Consequently, the latest expectations for strong world consumption will largely offset the bigger crop and keep corn prices supported.

The USDA Export Sales report is delayed one day due to a U.S. federal holiday on Thursday, but Monday’s Export Inspections report featured 0.563 MMT of corn inspections. That figure was down from the prior week but put 2021/22 YTD inspections at 6.037 MMT.

Midwest corn basis levels have been steady, on average this week, at -14Z (14 cents under December futures), equal with last week’s average. There are reports of processors and end-users in some regions having to increase bids to secure supplies, but the futures rally seems to have mitigated some of this impact. Basis levels are, however, still trading at or above their five-year highs for of the Midwest.

From a technical standpoint, December corn futures are still constrained to a wide, sideways trading range with long-term trendline resistance at $5.82 and support at $5.06 (the 13 October daily low). The 100-day moving average is acting as a swing point within that range and offering initial support below current values. If December futures can breakout above trendline resistance, the next upside target is the 12 August daily high ($5.94), followed by psychological resistance at $6.00. Conversely, a break below the 100-day moving average could push prices to $5.25 to $5.30, but end-user demand has been active on large breaks so far this year. Consequently, price weakness is likely to be short-lived and uncover strong buying interest while the “big” demand theme of the November WASDE could keep prices grinding higher.