Chicago Board of Trade Market News

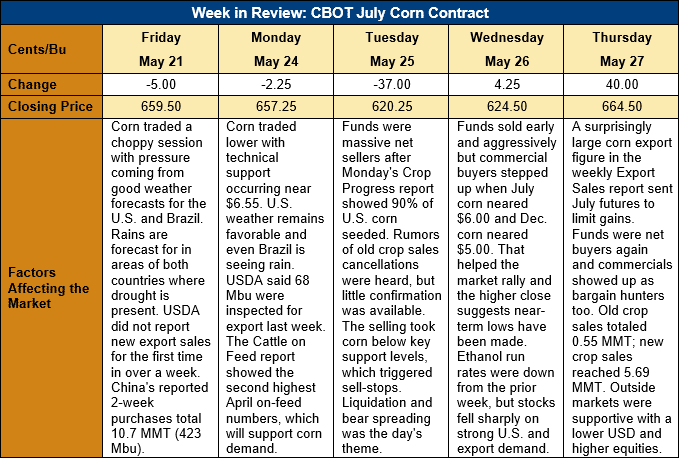

Outlook: July corn futures are 5 cents (0.8 percent) higher after a volatile week of trading. The market sank lower early in the week but Wednesday’s break to key support levels uncovered strong commercial and end-user buying. That, combined with larger-than-expected new crop export sales, triggered a limit-up move in July corn futures on Thursday. This week’s trade seemingly confirmed two things: that a near-term bottom is in place and that prices will remain volatile through the 2021 growing season.

On Monday evening, the USDA reported U.S. farmers had seeded 90 percent of their intended corn acreage – the fastest planting pace since 1988. Sixty-four percent of the crop has emerged, well above the average rate. The fact planting and emergence are running ahead of schedule has taken some production risk out of the equation. Combined with private firm estimates calling for final corn planted area 0.809-2.02 million hectares (2-5 million acres) above USDA’s latest estimates, the data suggest the 2021 corn crop will be ample.

The weekly Export Sales report found 0.555 MMT of old crop net sales and 1.85 MMT of exports. YTD exports total 49.137 MMT (up 78 percent) and account for 70 percent of USDA’s export forecast with 3 months left in the marketing year. More interestingly, USDA reported net new crop sales of 5.9 MMT- up 44 percent from the prior week – which brings total new crop sales to 14.6 MMT, up from 3.385 MMT this time last year.

One factor contributing to corn futures’ strength Wednesday and Thursday is the fact cash prices/basis levels have remained firm, despite futures’ market decline. On average, U.S. basis bids are 16 cents over July futures (16N), up from 17N last week and well above the -61N observed this time in 2020. FOB NOLA offers are essentially steady with the prior week at $304.70/MT with strong international demand enabling exporters to defend offers.

From a technical standpoint, July corn futures seem to be carving out a wide trading range. Wednesday’s early-day selling pressure took the market to $6.02 ¾ – a price end users and commercials apparently thought was a bargain. The fact the market approached but did not fully test (thanks to strong buying activity) the psychologically important $6.00 mark suggests Wednesday’s lows are the near-term/trading range lows. Thursday’s rally, which included fresh speculative buying, bull spreading, and short covering, took the market back above $6.50, a level that now looks like a pivot point for the future trading range. The upside targets are the 20 May high at $6.71 ¼, followed by $7.00 and, eventually, the contract high. Corn futures have a strong tendency to rally in June/July due to weather concerns and it seems traders, fully aware of this, are not getting overly short ahead of the summer growing season.