Chicago Board of Trade Market News

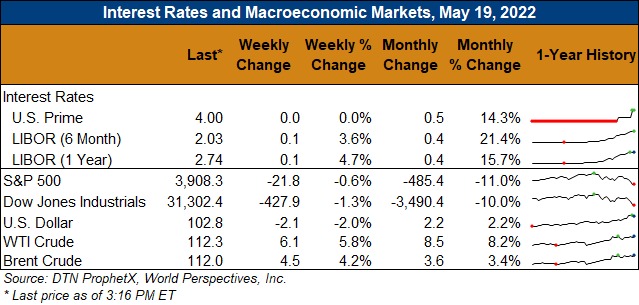

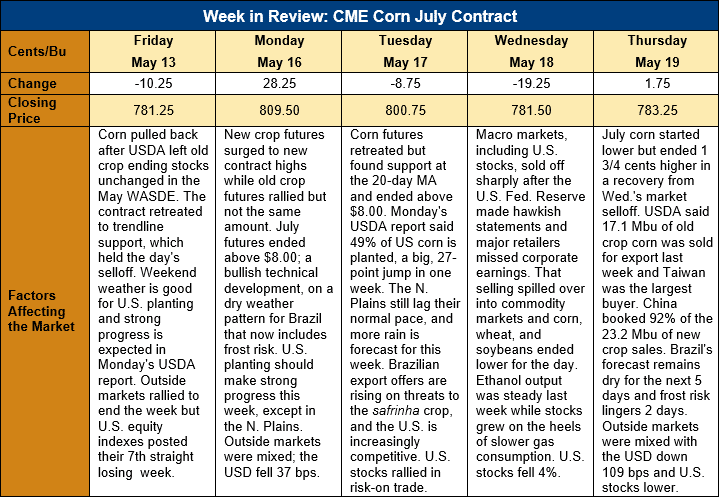

Outlook: July corn futures are 2 cents (0.3 percent) higher this week as weak macroeconomic markets again pressured futures on Wednesday, despite a firm fundamental outlook for corn. Production issues are increasing across multiple parts of the globe and markets are entering demand rationing mode.

The U.S. 2022 planting season is off to its slowest start since 2013 with 49 percent of the corn planted, down from the five-year average (which includes a severely delayed seeding in 2019) of 67 percent. U.S. farmers made strong (27 percent) progress last week, especially in the central Midwest and eastern Corn Belt. Seeding the northern Plains, however, continues to see difficulty with just 4 percent of North Dakota’s corn crop planted so far and 31 and 35 percent of South Dakota’s and Minnesota’s crops, respectively. The late planting increases the odds that some farmers will not seed fields and opt for Prevented Planting acreage crop insurance. The futures market rally, however, offers a strong incentive to plant fields even past the optimal planting window. The delayed planting has another likely impact that the crop in the northern Plains could enter pollination during the peak heat and dry weather season of late July.

Outside the U.S., the Brazilian safrinha crop is facing another week of dry weather, except for scattered showers in southern Brazil. This week, however, the crop also faces frost risk in the next two days that could also hurt yields. USDA left its estimate of the Brazilian crop unchanged in the May WASDE, but private analysts are still predicting a 5-10 MMT reduction in output. Moreover, in Europe, hot weather and growing drought is negatively impacting the European corn and barley crops, particularly in France. The French farm agency said the corn crop needs rain by June to avoid serious yield losses. The EU is expected to produce a corn crop of 68.2 MMT this year.

The weekly U.S. Export Sales report featured 0.435 MMT of net corn sales and 1.308 MMT of exports. The export figure was down 8 percent from last week but put YTD exports at 42.9 MMT, down 6 percent. YTD corn export bookings (exports plus unshipped sales) are down 13 percent at 58.93 MMT. New crop sales were strong last week as well with the U.S. booking 0.403 MMT of 2022/23 sales, 92 percent of which is destined for China. New crop sales currently total 5.58 MMT, up 14 percent from this time last year.

From a technical standpoint, July corn futures are now in a sideways trading pattern with support at the 10 May daily low ($7.69 ¼) and resistance at the contract high ($8.24 ½). U.S. cash basis levels remain strong, which should help support corn maintain their sideways/higher range. Should the market break its current trading range support, additional technical support lies at the 50-day moving average as well as the long-term trendline at $7.27 ½. Funds have yet to let go of their large and profitable long positions and are using breaks as buying opportunities. Seasonally, corn futures do not often rally heading into June but frequently post “weather scare” rallies in July. This year, with production concerns mounting in Brazil and Europe, futures are likely to remain elevated or move higher in demand-rationing fashion until production outcomes are more clearly known.