Ocean Freight Comments

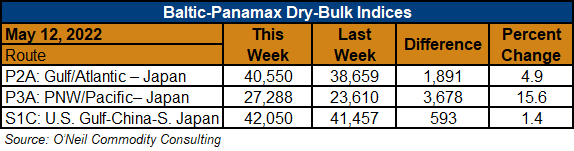

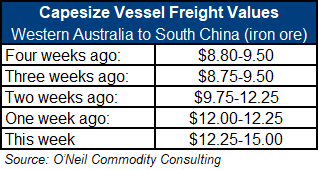

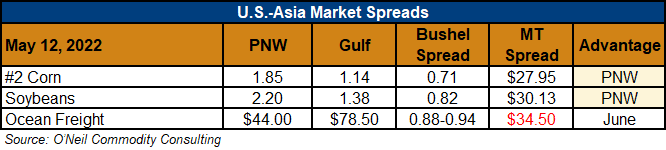

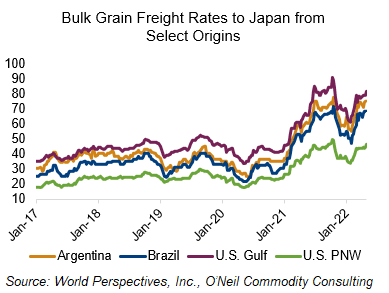

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: Even with Chinese bulk imports down by 9 percent YTD, this week’s uptick in Chinese iron ore demand caused excitement in global Capesize markets and they rallied higher. The rally prompted other vessel markets to decide to go along for the ride. Overall, global cargo demand for dry-bulk commodities does not look robust going forward. Traders have reason for hope that rates can climb higher in 2022, however, as Chinese port congestion and poor logistics are creating slow turn times. The small 2022-2023 new vessel order book for dry-bulk ships provides additional support for such thinking.

Container markets are, of course, dealing with the same Chinese port congestion issues and difficult logistics. When Chinese ports fully reopen from lock down requirements, a big wave of imports will hit U.S and E.U. container ports.