Chicago Board of Trade Market News

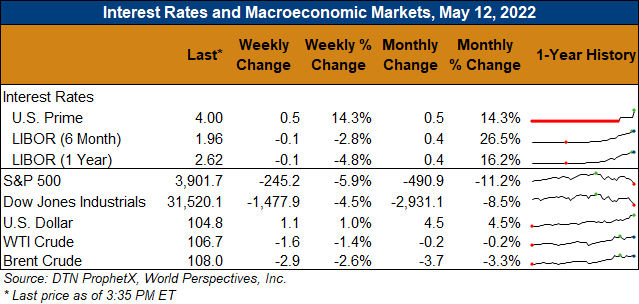

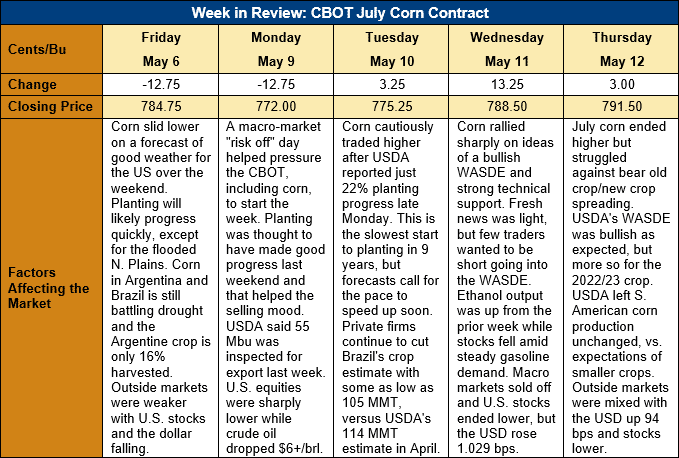

Outlook: July corn futures are 6 cents (0.9 percent) higher this week as weak macroeconomic markets pressured early-week trade, but bullish fundamentals sparked a rally before the May WASDE. USDA’s report offered bullish support for the market and July futures finished 3 cents higher after the WASDE’s release while the December contract posted a 17 ¼-cent gain.

USDA’s May WASDE was expected to be bullish the grain markets and it did not disappoint. For corn, USDA noted its outlook is for “lower production, domestic use, exports, ending stocks, and higher prices”. USDA noted the slow start to the U.S. corn planting (the slowest in 9 years with just 22 percent seeded as of Sunday) is expected to curb the 2022 crop’s yield potential. USDA estimate the new crop yield at 11.12 MT/ha (177 bushels per acre), which was down from the February Ag Outlook Forum’s forecast. UDSA’s 2022 yield forecast is 4.3 percent below the 2021 estimate and, when combined with the 4.2 percent acreage decrease, total production is set to decrease 4.3 percent from 2021/22.

On the demand side, USDA expects 2022/23 ethanol use of corn to remain unchanged from 2021/22 based on the agency’s expectation of motor gasoline consumption. USDA did, however, reduce expectations of feed and residual corn use due, partly, to smaller livestock herd numbers. Perhaps most interestingly, the agency lowered the 2022/23 corn export forecast by 4 percent to 60.96 MMT (2.4 billion bushels) as “lower supplies and robust domestic demand limit [export] prospects.” Despite lower total exports, the U.S. share of total world exports is up from 2021/22 due as the ongoing conflict in Ukraine will limit that country’s exports.

Outside the U.S., USDA left the Brazilian corn crop estimate unchanged at 116 MMT for 2021/22. The move was contrary to the average 113.9 MMT estimate indicated by pre-report surveys. USDA also left the Argentine 2021/22 corn crop unchanged at 53 MMT, versus expectations of a 1-MMT decline. For the 2022/23 marketing year, world corn production was pegged at 1,180 MMT, down 1 percent from 2021/22 due to smaller crops in Ukraine, the U.S., EU, and China. World corn imports were forecast at 176.8 MMT, down 2 percent, while global ending stocks are expected to decline 1 percent due to smaller carry-out in China and the U.S. that is partly offset by gains in Ukraine, Brazil, and Serbia.

The weekly U.S. Export Sales report featured 0.192 MMT of net corn sales and 1.504 MMT of exports. The export figure was down 21 percent from last week’s marketing year high but was still above the 4-week moving average. YTD exports total 41.5 MMT, down 8 percent, while YTD bookings (exports plus unshipped sales) are down 14 percent at 58.49 MMT. Last week’s sorghum exports were up 28 percent at 0.27 MMT, putting YTD shipments of the commodity at 5.15 MMT (down 10 percent).

From a technical standpoint, July corn futures are still trending higher with trendline support at $7.73 but the market may be starting to turn sideways. New crop futures are trending higher as well and bear old crop/new crop spreading could keep July futures moving in a sideways range. Funds remain long the market but still have room to add to positions, based on current and historic trends in open interest. Notably, corn futures are approaching the time of year when weather forecasts play an outsized role moving prices and the market typically sees a summer “weather scare” rally. With USDA having already cut U.S. yield prospects due to the slow planting, the futures market is apt to be even more sensitive to worsening Corn Belt weather forecasts.