Chicago Board of Trade Market News

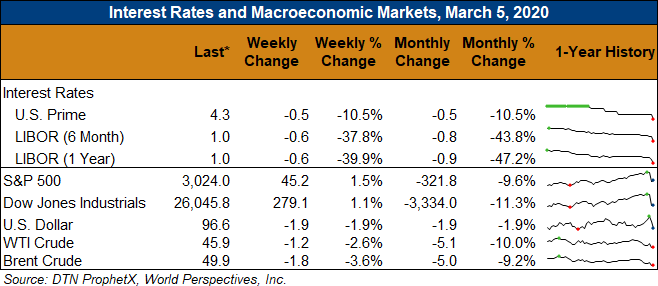

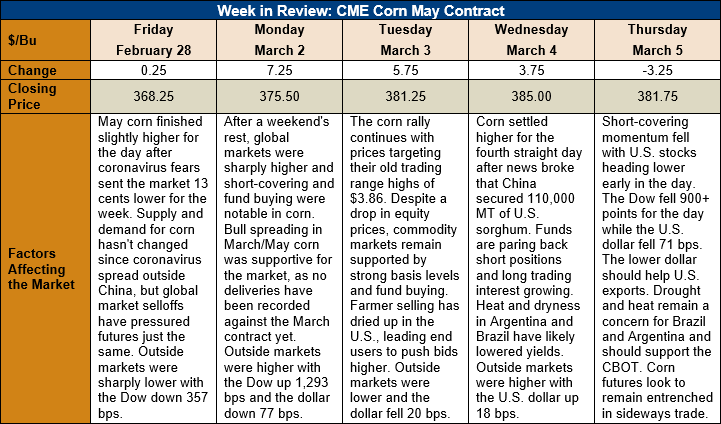

Outlook: May corn futures are 13 ½ cents (3.7 percent) higher this week as agricultural commodities have rallied following last week’s coronavirus-inspired selloff. Global equity markets remain highly volatile, but commodities are returning to supply and demand fundamentals are their primary drivers. Following last week’s selloff, managed money funds have been net buyers of corn futures and are slowly paring back their short position.

The weekly Export Sales report featured improving sales and exports of corn, with 769,200 MT of net sales recorded last week and exports of 884,600 MT. The export figure represents a 5 percent increase from the prior week. YTD bookings (exports plus unshipped sales) are 26.6 MMT, down 34 percent. Sorghum sales and exports were large last week, with 71,600 MT of net sales and 93,200 MT of exports. YTD sorghum bookings are up 99 percent at 1.7 MMT. Barley exports reached 600 MT last week and YTD bookings for the commodity are 49,200 MT, down 17 percent.

Cash corn prices are up 5 percent from last week, rallying on a combination of higher futures prices and strong basis levels. Farm sales of corn have slowed in recent weeks, leading end users to increase bids and aggressively procure the grain. Basis levels are 9 cents under May futures on average across the U.S., steady with last week but well above last year’s levels of 72 cents under May futures. Barge CIF NOLA values are 6 percent higher while FOB NOLA offers are up 5 percent at $178.50/MT.

Notably, the strong pace of sorghum exports, including 110,000 MT sold to China this week from the 2019/20 crop, has pushed sorghum prices higher as well. FOB NOLA offers reached 120 cents over May corn futures this week, up from 98 cents over last week.

From a technical standpoint, May corn futures have re-entered their sideways trading pattern that was exited last week. The market faces notable technical resistance at $3.86 and this will likely form the ceiling for price action in the near-term. The initial floor for the new trading range is $3.75 and $3.80 will likely be a key pivot point going forward.

Fundamentally, the market continues to watch for continued improvement in U.S. corn exports and the shipment pace through the spring will be crucial for determining price action. Traders are also starting to watch the outlook for the 2020/21 crop, and current long-term forecasts suggesting another wetter-than-normal spring could spark a market rally if realized. The South American crops are developing in favorable conditions overall, but dryness is spreading across Southern Brazil and Argentina. Overall, the fundamentals point towards more sideways trade while the market waits for a dominant “story” to develop.