Chicago Board of Trade Market News

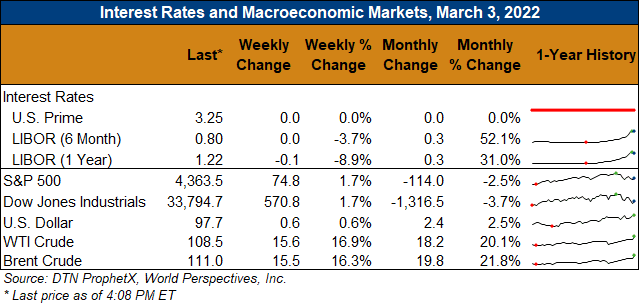

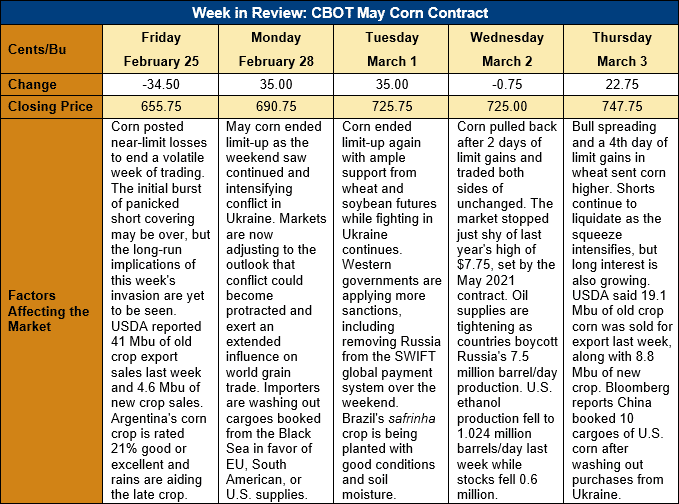

Outlook: May corn futures are 92 cents (14 percent) higher this week as the ongoing conflict in Russia and escalating economic sanctions against the country throw world grain markets into a demand-rationing rally. Spot corn futures rose to their highest level since December 2012 on Thursday and settled just $1.04 below the all-time high $8.49 set on 6 August 2012), posting a 92-cent gain for the week. While the corn market’s rally is impressive, wheat futures have seen the greatest rally since the invasion began, and May wheat futures are up 264 ¼ cents this week after settling at their limit bid each of the past four trading sessions. The strength in wheat futures is lending secondary support to other feed grain markets, which face their own bullish fundamentals.

The lack of access to export ports in Ukraine and financial sanctions hindering trade with Russia is causing global importers to switch shipments booked from the Black Sea to other suppliers. China has reportedly booked 10 cargoes of corn from the U.S. this week while buyers in the Middle East are turning to EU-origin corn. The sudden shift in world trade patterns is causing basis levels and spreads between various markets to deviate significantly from normal.

The weekly Export Sales report showed U.S. exporters booking 0.485 MMT of net sales for the 2021/22 marketing year, along with 1.55 MMT of exports. Both figures were down from the prior week but YTD exports now total 25.77 MMT, down 2 percent. YTD bookings for the 20221/22 crop year total 48.06 MMT, down 19 percent but accounting for 78 percent of USDA’s latest WASDE forecast. Exporters also registered 0.102 MMT of sorghum net sales, putting YTD bookings at 6.667 MMT (up 13 percent).

Export activity for the 2022/23 marketing year has been picking up and exporters recorded 0.223 MMT of net sales last week. YTD bookings for the new crop total 1.906 MMT, up 55 percent from this time last year.

Examination of futures market open interest indicates that short covering is driving much of the ongoing wheat rally, but the same cannot be said of corn. Open interest is rising in corn futures, which suggests traders are adding to existing positions (either speculative longs or commercial/hedge selling short positions). The distinction is important as short-covering rallies tend to fade and reverse much quicker than long-interest fueled rallies.

From a technical standpoint, May corn futures are rallying sharply with no sign yet of a market top. The wheat rally continues to provide spillover support while the shift of world import demand to the U.S. provides a bullish fundamental backdrop. Technically, May corn now has technical resistance at Thursday’s contract high ($7.60) but that level could easily be overcome with another bullish day in the markets. Long-term resistance and psychological lies near $8.00 and it will be interesting to see how the market behaves around that level if reached. Trendline support lies at $6.67 – well below Thursday’s close – but psychological support likely lies between $6.90-7.00 and at $6.75 after that.