Chicago Board of Trade Market News

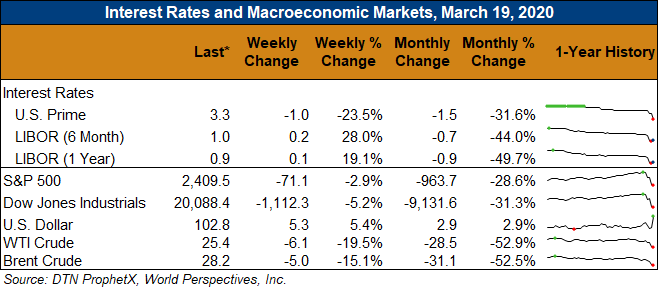

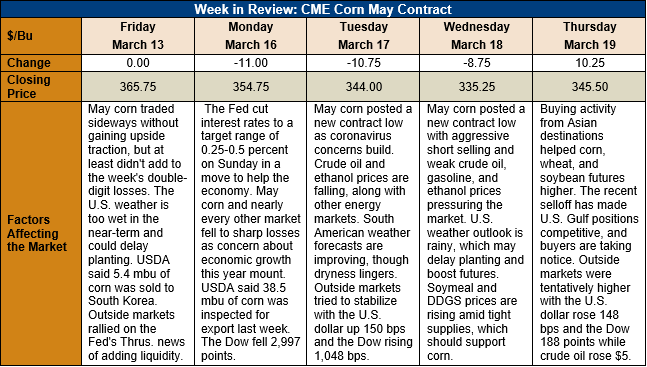

Outlook: May corn futures are 20 ¼ cents (5.5 percent) lower this week as selling continues to dominate the global markets. Continued concerns about the economic impact of the coronavirus COVID-19’s spread are keeping equity and energy markets highly volatile and mostly lower. Governments around the world are enacting policies to combat/contain the virus itself as well as fight the economic slowdown. Ag commodities have been caught up in the selling but have been relatively immune from drastic shifts in the fundamental supply/demand outlook.

The weekly Export Sales report featured a slight dip in net corn sales for 2019/20, which reached 904,500 MT last week. Weekly corn exports, however, notched a marketing-year high at 970,000 MT, up 14 percent from the prior week. The latest data puts YTD exports down 42 percent while YTD bookings (exports plus unshipped sales) are down 31 percent. The report featured 366,000 MT of net sorghum sales and 74,900 MT of exports. The export rate was up 467 percent from the prior week and puts YTD bookings up 150 percent. USDA reported 200 MT of barley was exported last week, keeping YTD shipments at 34,400 MT, up 5 percent.

Cash corn values are lower across the U.S. this week with the futures market pressuring values. Additionally, end-users are backing off on bids, having secured sufficient near-term supplies. The average basis level for corn in the U.S. fell to 31 cents under May (-31K) futures this week, down from -13K the prior week. Barge CIF NOLA corn values are down 5 percent this week at $157.75 while FOB Gulf offers are also 5 percent lower at $164/MT for spot shipment. Prices are attracting international demand, with industry sources noting Asian buyers are actively inquiring for and booking product.

Sorghum prices continue to move higher with international demand remaining robust. Basis offers for Texas Gulf sorghum hit 140 cents/bushel over May futures as China, Japan, and Mexico have each secured product in the past week. Higher sorghum prices are working to help boost demand for corn.

From a technical standpoint, May corn futures rallied on Thursday, defying new contract lows that were scored the prior day. The contract had become technically oversold amid aggressive fund selling and was ripe for a corrective bounce. Thursday’s move higher was motivated by industry stories of Asian buyers securing U.S. Gulf corn and other commodities. The trend remains lower for May corn futures, but short traders will likely have to cover some of their position as export demand improves, which will create additional upside potential for the market.