Ocean Freight Markets and Spreads

Ocean Freight Comments

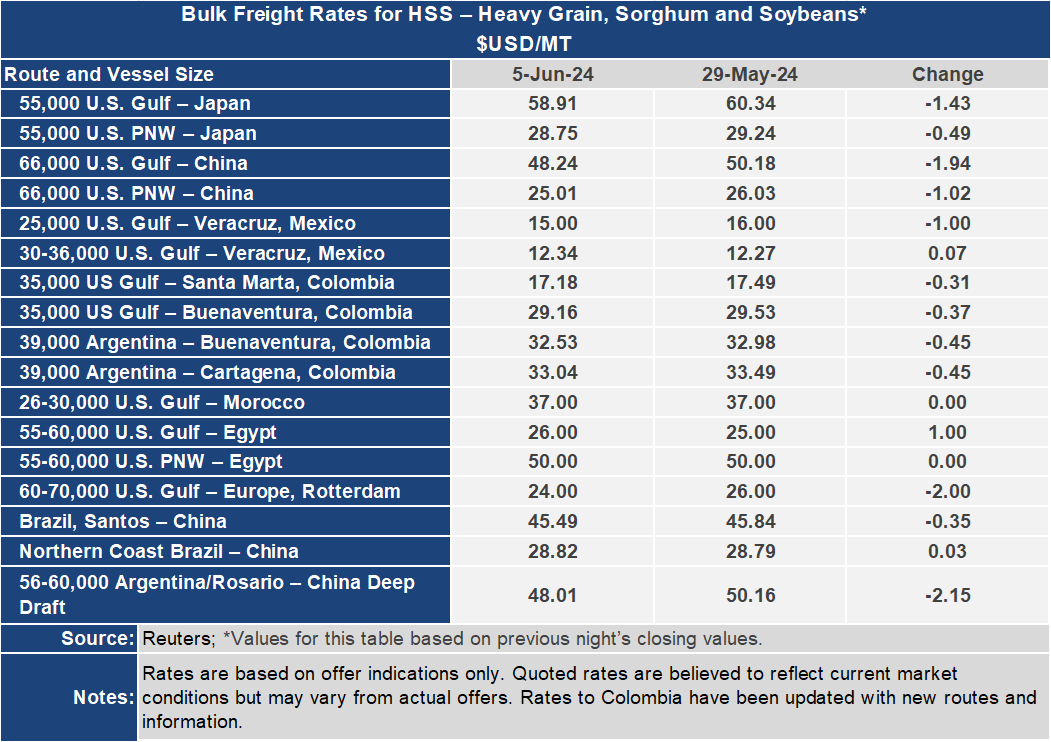

Changes to the Colombia routes in the Bulk Freight Rates for HSS – Heavy Grain, Sorghum and Soybeans appear in this week’s table. There are now four routes, two from the United States and two from Argentina going to both east (Santa Marta and Cartagena) and west Colombia (Buenaventura). The routes reflect the common vessel size deployed and volumes shipped on those routes.

Restoration of the full navigation channel to and from the Port of Baltimore to a 700-foot channel width and a depth of 50 feet will happen between Saturday, June 8 and Monday, June 10. The removal of last impending structure of the former Francis Scott Key Bridge happened on Tuesday, June 4. The incident response team is conducting final scans to assure the channel is clear. The Key Bridge collapsed after the m/v Dali lost power and allided into it on March 26.

Based on improving water conditions, the Panama Canal Authority increased draft capability through the Neopanamax locks to 45 feet from 44 feet last week. The maximum designed draft is 50 feet. This was more than two weeks earlier than expected. There is still a restriction on the number of daily vessel transits of 32, and this too will likely be lifted over the coming weeks. Under normal navigation conditions daily transits average about 34 to 36. Water levels in Gatun Lake continue to improve, though forecast levels are below normal levels for July and August. Regardless, the El Nino induced drought that affected Panama during 2023 and early 2024 is becoming a memory. There has been increased vessel activity heading to the Panama Canal to shorten sailing times between the United States and Asia while having a lower freight rate to offer.

The Rhine River has been closed to navigation on some segments due to high water levels that is restricting barge tows to pass under bridges and other infrastructure. Conditions are improving and full navigation is expected to resume Friday, June 7 at the earliest. In the United States, water levels on the Lower Mississippi River are adequate and replenished. There are high water levels in some segments, but they are not affecting navigation greatly.

Following last weeks increased terrorist activity by the Houthis, the unified naval command that includes the United States, United Kingdom and Greece retaliated to slow the Houthis. However, the calm lasted a short while as the Houthis returned to attack three vessels, two in the Red Sea and one, a U.S. flagged vessel, in the Arabian Sea. No injuries or damage were reported. Despite on-going attacks, which have expanded from the Red Sea to around the Arabian Peninsula, vessel owners and operators rerouted vessels and adjusted sailings to avoid the region, opting for long haul routes including around the Cape of Good Hope. The impact has led to supply chain disruption on the key Asia and Europe and Middle East trade routes. The Houthis attacks are not expected to end any time soon.

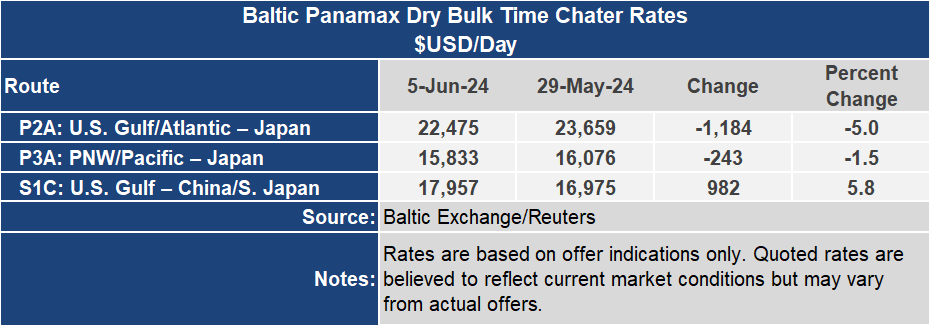

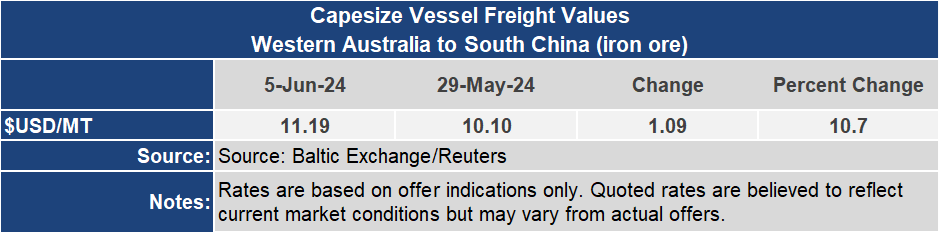

Baltic indices kept a mixed tone going into this week. The Capesize index was up 10.1% or 271 points to 2,945. The Panamax index weakened 3.4% to 1,702 and the Baltic Supramax that was down 2.7% to 1,258. The Baltic Dry Index finished the week 3.5% higher on the strength of the Capesize market to 1,852. Freight demand is still wayward with no breakout in one direction or the other.

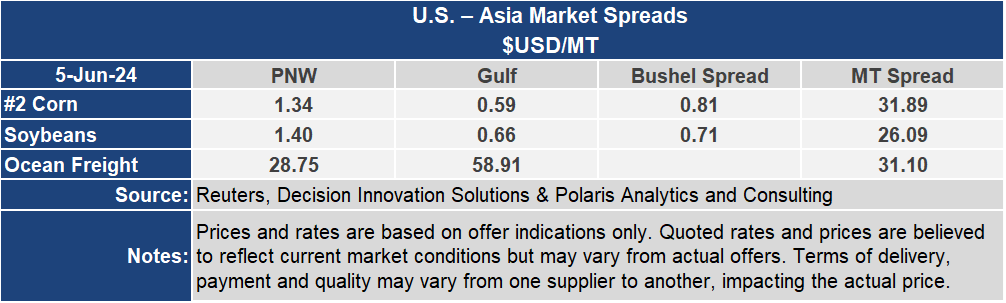

On the U.S. grain routes to Asia, rates were lower across all routes, with the Gulf to Japan rate down 2.4% or $1.43 per metric ton to $58.91, its lowest level since February 28. The rate from the Pacific Northwest to Japan was 1.7% or nearly 50-cents per metric ton lower to $28.75. The spread on these venerable routes narrowed 3% or 94-cents to $30.16 per metric ton. This is the narrowest spread since March 1. As routing confidence through the Panama Canal gains momentum, this spread will likely narrow further on a lower Gulf to Asia freight rate.

Container ocean freight rates for May were updated this week. Rates out of the United States to Asia were strongest to South Asia to Malaysia, Indonesia, Philippines and Vietnam up double digits from April by 9% (Philippines) to 21% (Vietnam).