Chicago Board of Trade Market News

Outlook

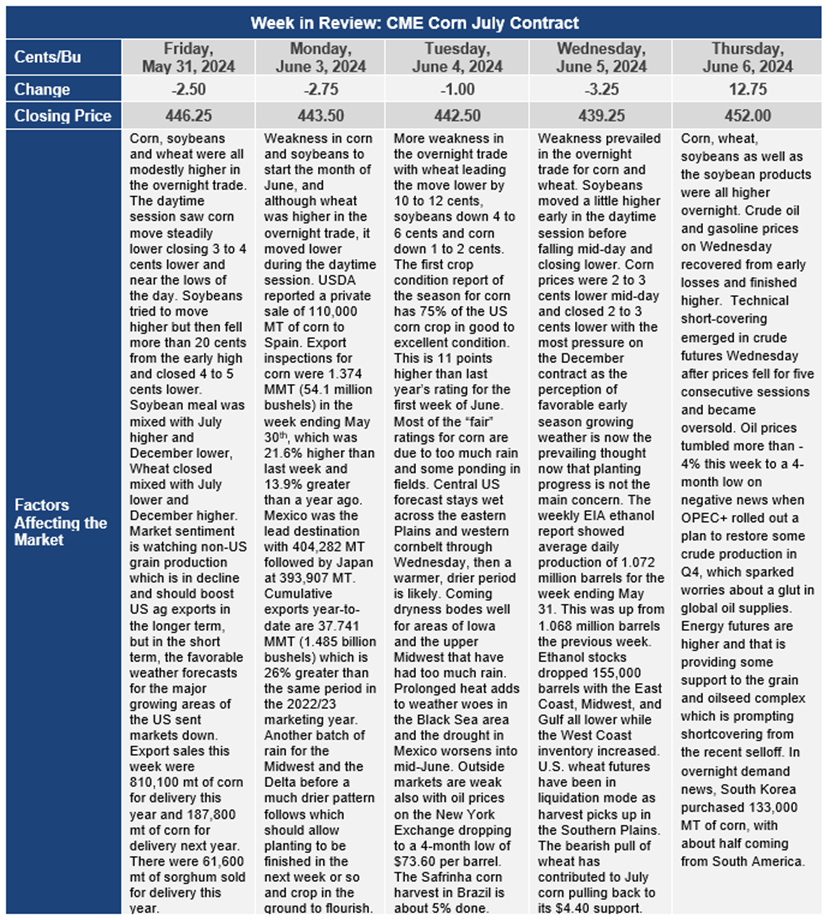

Corn futures are at a critical point if the uptrend that has been developing since early March is to remain intact. Support currently rests around $4.40 basis for the July contract. Failure to hold this level would likely trigger a resumption of the downtrend that began nearly a year ago. Fears that a significant portion of the U.S. corn crop would not get planted have abated, although there is likely to be some yield loss compared to trendline yield due to the portion that was or will be planted after June 20th. The replenishment of soil moisture conditions that were severely below normal when planting began in April combined with relatively mild weather as the crop begins its early growth stages sets the stage for high crop condition ratings, at least during the first part of June and turns thoughts to prospects of a large crop being harvested this fall and a further buildup of ending stocks rather than a pull-down in ending stocks that was one of the main take-aways from the May WASDE report.

Searing heat and ongoing dry weather are reducing estimates of Ukraine and Russian wheat production while excessive rainfall is pushing the seeding of the spring wheat crop in Russia beyond the optimal dates in both northcentral and northeastern Russia. Besides the Black Sea drought conditions, weather issues abound around the world. Mexico continues to be in the grips of the worst drought that country has seen in 50 years. Northern and Central China’s dryness is beginning to rise on the radar screens of traders as more heat is developing in those growing regions. A lack of rainfall and relatively high temperatures in the upper 80s, 90s and low 100s will cover about 60% of China’s winter wheat area and up to 25% of China’s cornbelt. And just after southern Brazil experienced record flooding, both Argentina and Brazil are in a period of dryness with limited rain in the forecast to seed winter crops in Argentina. The only real bright spots for crops are the corn and soybean fields that are within a couple hours travel time by car of the Chicago traders. As they go out and about, they see a very good crop developing and just read about the negatives happening elsewhere.

U.S origin corn is becoming more competitive in world markets. Not only has the futures price declined significantly over the past couple weeks, but Argentina’s cash corn market added premium this week. On a landed basis, U.S. origin corn is cheapest into Asia for summer delivery. A year ago, South American basis was deeply negative, but now is much closer to “normal” and showing signs of increasing even more.

Net corn sales of 1.18 MMT for 2023/24 were up 46% from the previous week and 41% from the prior 4-week average. Increases primarily came from Mexico, Japan, Spain, China, and Colombia. Export shipments of 1.49 MMT were up 43% from the previous week and 27% from the prior 4-week average.

Longer term, an increasingly bright U.S. export outlook is emerging. Around 30% of Ukraine’s cornbelt will endure deepening drought. Unwavering heat is sharply cutting into the yield potential of Mexican corn. If heat and dryness persist in China, then world trade in corn could pick up and the U.S. is positioned with quite adequate supplies and, at least for the moment, very good prospects for the crop that is underway. Longer-term climate models are beginning to signal lasting dryness across the U.S. Plains states and the western part of the U.S. Cornbelt. Early crop conditions ratings have a very low correlation to final crop yields – around a 16% correlation – whereas crop condition ratings in August have about a 70% correlation to final yields. The current U.S. crop has a long way to go, and it is unlikely that crop condition ratings will get much better than they currently are. The current market may be offering an excellent opportunity for longer-term coverage for those who will need corn in the future.