Chicago Board of Trade Market News

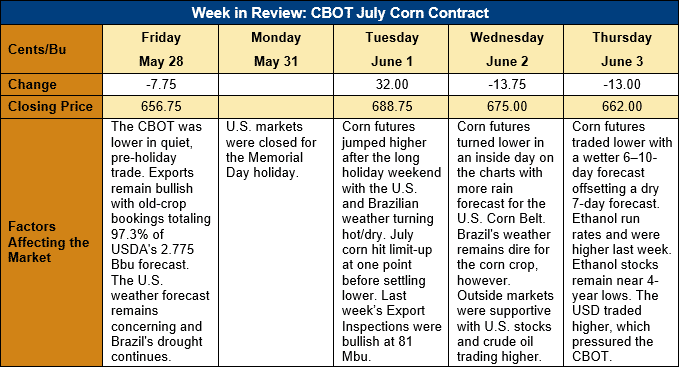

Outlook: July corn futures are 5 ¼ cents (0.8 percent) higher after a holiday-shortened week of trading at the CBOT. Early week trade saw futures follow through on last week’s reversal, but sideways trade developed Wednesday and Thursday. The U.S. crop is safely in the ground and off to a solid start, but June weather forecasts are concerning. Overall, it seems old crop futures are being driven by export data while the new crop market is increasingly weather dominated.

On Monday evening, the USDA reported U.S. farmers had seeded 95 percent of their intended corn acreage, essentially concluding the fastest planting since 1988. Eighty-one percent of the crop has emerged, well above the 5-year average emergence rate of 70 percent. USDA’s initial corn conditions ratings pegged the crop at 76 percent rated good/excellent, above last year’s initial rating (70 percent) and above the 5-year average 72 percent good/excellent rating. Early season crop conditions ratings have a poor correlation with final yields, but, nevertheless, the current strong ratings are encouraging.

The weekly Export Sales report is delayed due to the U.S. Memorial Day holiday, but the Export Inspections report saw 2.049 MMT shipped last week, a bullish volume that was above what was needed to keep pace with the USDA’s latest forecast. To date, 2020/21 corn export inspections total 50.9 MMT, up 78 percent.

The CBOT seems to have officially entered its seasonal “weather mode” – where the day’s trading action is mostly defined by the latest weather forecast. This week, those forecasts have been mostly bullish with hot, dry weather forecast for the U.S. Western Corn Belt and northern Plains through June. Brazil’s weather is unchanged from its record-breaking drought and safrinha corn crop production estimates are being continually lowered. The consensus now seems to be that the total Brazilian 2020/21 corn crop will be 90-92 MMT, down from USDA’s May WASDE estimate of 102 MMT. Markets are likely to remain on edge until Brazil’s production estimates stabilize or the U.S. weather forecast shows consistent showers for the Plains and Corn Belt.

U.S. cash prices/basis levels remain firm, a hallmark of a demand-led bull market. On average, U.S. basis bids are 13 cents over July futures (13N), up from 15N last week and well above the -61N observed this time in 2020. FOB NOLA offers are slightly lower this week at $300.18/MT.

From a technical standpoint, July corn futures are in a wide trading range from last week’s lows ($602. ¾) to Monday’s high at $6.96 ¾. The $6.50 mark is the likely swing point in that range and an upside breakout suggests trade to the contract high. Give the volume of support uncovered last week at the $6.00 level, it seems a downside breakout is unlikely without a major shift in global market fundamentals. Funds remain heavily committed to the long side of the market but have been reluctant to extend that position so far this week. Exports and weather forecasts remain supportive and technical indicators are pointing higher as well. For now, it seems sideways/higher trade is the most likely outcome for the CBOT.