Chicago Board of Trade Market News

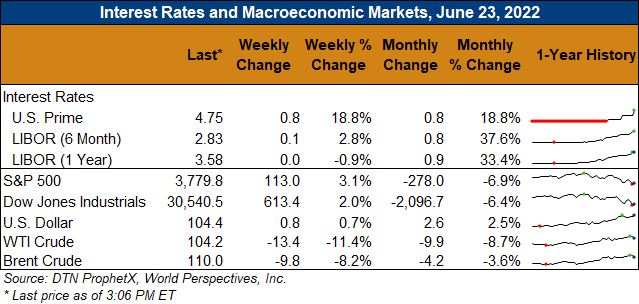

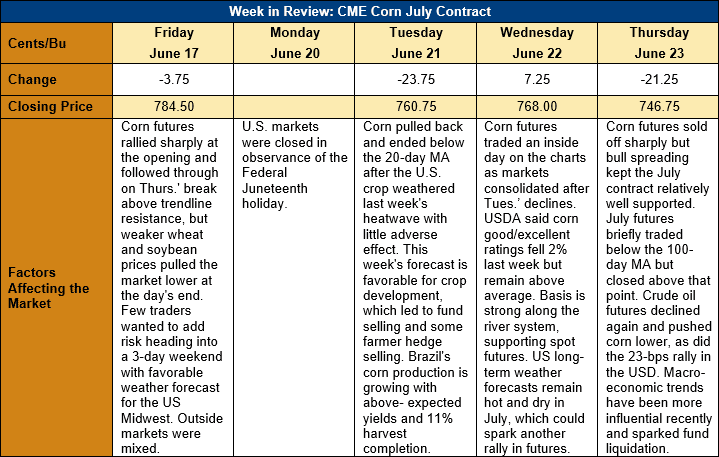

Outlook: July corn futures are 37 ¾ cents (4.8 percent) lower in a holiday-shortened trading week with favorable weather in the Midwest and a broader market selloff creating the weakness. Technical conditions are starting to breakdown as well, leading to additional fund liquidation selling. Outside markets also offered little support to corn futures with crude oil futures pulling back to $104/barrel and the U.S. dollar trading near 20-year highs.

The U.S. corn crop appears to have endured last week’s heatwave largely unscathed, with the share of the crop rated good/excellent totaling 70 percent. That rating was down 2 percent from the prior week but 2 percent above the five-year average. According to the USDA’s latest report, 95 percent of the crop is emerged, in-line with the five-year average. The weather forecast for the coming week features below-average temperatures for most of the corn belt with near-average precipitation. Temperatures should remain moderate heading into early July, but the long-term forecast still favors a hot, dry trend that will likely be bullish.

The weekly Export Sales report is delayed due to Monday’s Federal holiday in the U.S., but the Export Inspections report featured 1.184 MMT of inspections. That figure was down 3 percent from the prior week but above pre-report estimates and put marketing year-to-date inspections at 46.162 MMT, down 18 percent. Despite the lower inspections figure last week, basis along the river and barge rates remain firm and at or above five-year highs as commercial and export demand remains strong.

From a technical standpoint, July corn futures failed to follow through on last week’s rally above trendline resistance and that bullish development now looks like a false signal. The contract has survived the week’s selling better than new crop futures due to strong bull spreading and steady commercial demand. So far, U.S. farmers have not been significant sellers on the decline, which has helped keep basis firm in most regions and support the spot contract. July futures briefly traded below the 100-day moving average on Thursday, but that break triggered short-covering and some end-user buying that helped push the contract off the day’s lows. July corn looks to be stabilizing heading into first notice day at the end of this month and the outlook for new crop futures is largely weather-dependent. This week’s shift towards favorable U.S. weather allowed the market to pull back from recent highs, but the long-term weather forecast remains bullish.