Chicago Board of Trade Market News

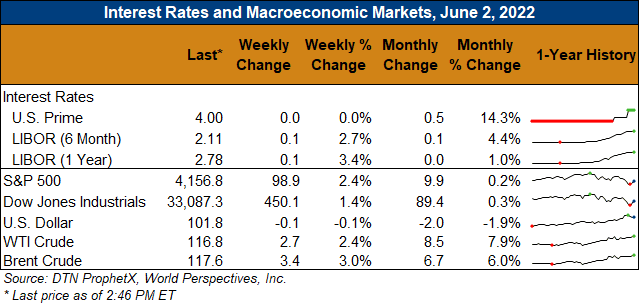

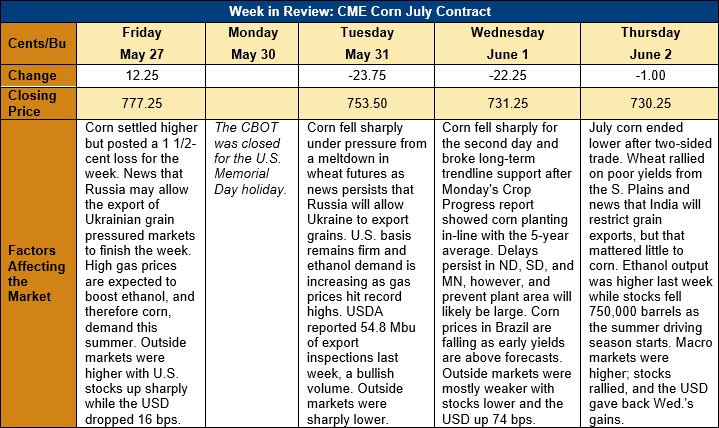

Outlook: July corn futures are 47 cents (6.0 percent) lower this week after sharp selling on Tuesday and Wednesday. The selloff’s catalyst was news that Russia may allow Ukraine to export grain via the Black Sea, even while the conflict is ongoing. That news sent wheat futures sharply lower, and the selling spilled over into corn futures. There are ample reasons to doubt whether Russia will permit Ukraine to export its crops, but markets were in “sell the rumor” mode this week. If nothing else, this week proved again that the Russia-Ukraine conflict remains a massive fundamental driver for world grain markets.

Another week of favorable weather allowed U.S. farmers to plant 14 percent of the corn crop, with 86 percent of fields seeded through Sunday. That compares to a five-year average pace of 87 percent with the most notable delays still existing in North Dakota, Minnesota, and, to a lesser extent, South Dakota. Also notable is the fact that the Canadian province of Manitoba has seeded just 40 percent of its spring crops. Another year of smaller acreage and/or production in Canada could sustain the record-breaking pace of U.S. corn export to Canada into 2022/23.

The weekly Export Sales report is delayed until Friday, June 3 but the Export Inspections report featured 1.39 MMT of corn inspections last week. That figure was down from the prior week but put marketing year-to-date (MYTD) inspections at 42.2 MMT, down 17 percent. The report also noted 143 KMT of sorghum exports, which put MYTD inspections for that crop at 6.12 MMT, down 1 percent from 2020/21.

U.S. basis levels continue to rise amid strong commercial demand, with the average Midwest basis reaching 1N (1 cent over July futures) this week. That is up from -4N last week but below the 11N recorded this time last year. Notably, rising gasoline prices are stimulating ethanol demand and corn basis near ethanol plants remains exceptionally strong as the industry bids for additional supplies.

From a technical standpoint, July corn futures sold off sharply and broke trendline support amid funds’ long liquidation trade early this week. Commercial traders and end users appear to have stepped up buying on the breaks, however, and support developed near $7.20 and $7.25 on Wednesday and Thursday, respectively. July corn has support at the 100-day moving average ($7.14) and the 29 March daily low ($6.95). Amid smaller U.S. acreage and increasing risk of 1-2 million acres of “prevent plant” area heading into what is forecast to be a warmer and drier than normal summer, additional downside risk may be limited.