Distiller’s Dried Grains with Solubles (DDGS)

DDGS Comments: DDGS prices are $10/MT lower this week as markets remain thinly traded amid the start of summer vacation season. Additionally, early-week breaks in CBOT corn and soymeal futures pressured DDGS values, along with an increase in ethanol plant run rates. Buyers remain content for now and are buying on an “as needed” basis. One trader reported that this week’s rains in the Midwest and Canadian prairies have made buyers more comfortable with feed supply prospects this year, which is contributing to some of the market slowness.

The DDGS/Kansas City soymeal ratio at 0.54, down from last week’s ratio of 0.58 and above the three-year average of 0.48. The DDGS/cash corn ratio is at 0.85 this week, down from 0.93 last week and below the three-year average of 1.07.

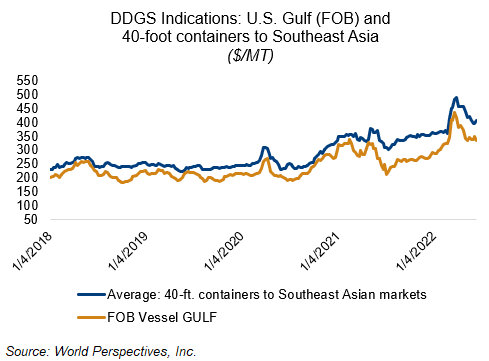

On the export market, Barge CIF NOLA offers are $10-15/MT lower this week, erasing last week’s gains and continuing a choppy, mostly sideways trading pattern. FOB Gulf offers down $15/MT for June through August at $330/MT. Offers for 40-foot containers to Southeast Asia, however, are higher by $10-14/MT this week at an average offer of $412/MT.