Chicago Board of Trade Market News

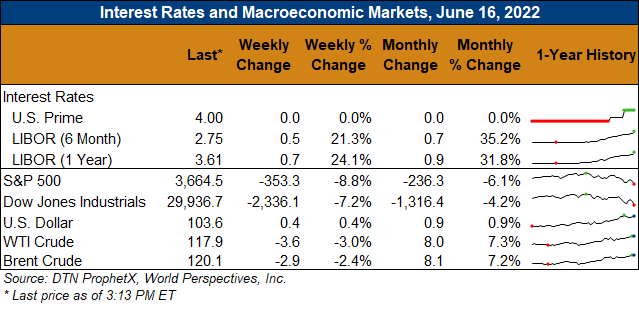

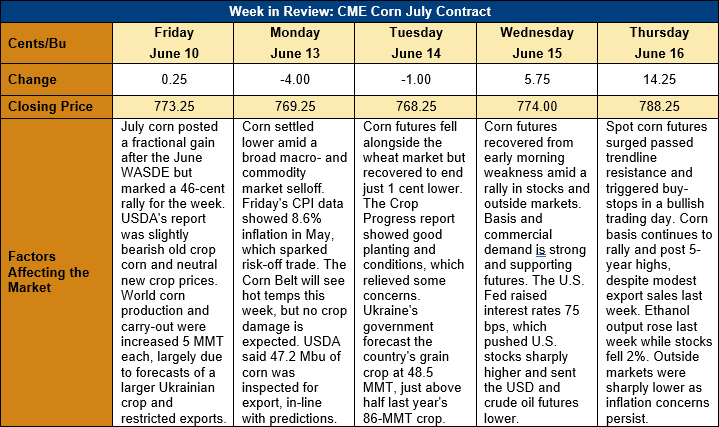

Outlook: July corn futures are 15 cents (1.9 percent) higher this week with most of those gains developing Thursday amid a technical rally and strong commercial demand. The contract settled 14 ¼ cents higher on that day after essentially sideways trade earlier in the week. Spot corn markets are seeing increased competition for grain among ethanol plants, livestock end-users, and the export market that is supporting basis and futures prices.

With fuel prices continuing to rise and uncertainty in the world grain production outlook, demand for old crop corn is rising steadily. Merchandisers note that corn processors have increased bids to secure old crop grain while barge rates and FOB Gulf offers are higher as the export market tried to procure product as well. Barge rates on the Mississippi river are also trending higher amid the demand surge. The competition for grain has pushed spot basis to a five-year high of 10N (10 cents over July futures), up 2 cents from last week and above the 6N recorded this time last year.

The weekly Export Sales report featured 259 KMT of new, old-crop corn sales, down from the prior week, and 1.387 MMT of corn exports. The export figure was steady with the prior week but above expectations, which helped support the futures market’s Thursday rally. Year-to-date, U.S. exporters have shipped 49.07 MMT of corn and recorded 59.66 MMT of total bookings (exports plus unshipped sales). The YTD export figure is down 10 percent while YTD bookings are 14 percent below 2020/21.

Last week’s WASDE report offered little fresh information for the futures market with USDA making only minor adjustments to the U.S. corn balance sheet. The agency lowered 2021/22 corn exports slightly and added that figure to old-crop ending stocks and the new-crop carry-in. The larger beginning stocks for 2022/23 was one of two changes to the new crop balance sheet, with the other being a 127 KMT (5 million bushel) increase in food, seed, and industrial corn use. Ending stocks increased in accordance with the larger carry-in, though USDA left its 2022/23 average farm price unchanged at $265.73/MT ($6.75/bushel).

Outside the U.S., the theme of USDA’s June WASDE was for larger world corn production and ending stocks. World corn production for 2022/23 was raised 5.1 MMT, due largely to better-than-expected planted area in Ukraine. World corn ending stocks grew 5 MMT, due expectations of Ukraine’s export potential and the modest adjustment to U.S. carry-out. Overall, the report was in-line with expectations and left and major market-moving changed for latter this summer.

From a technical standpoint, July corn futures extended last week’s rally from support near $7.25 and broke above trendline resistance at $7.80 on Thursday. The move above technical resistance triggered buy-stops that helped accelerate the rally and pushed the contract within 8 cents of the $8.00 mark. Late-week strength in market technicals, basis, and commercial demand will likely keep the market grinding higher, though volatility will likely increase as first notice day (30 June) draws near.