Chicago Board of Trade Market News

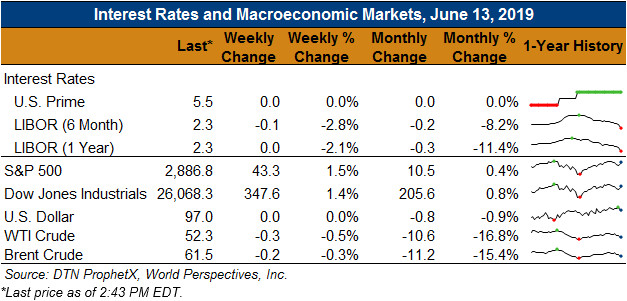

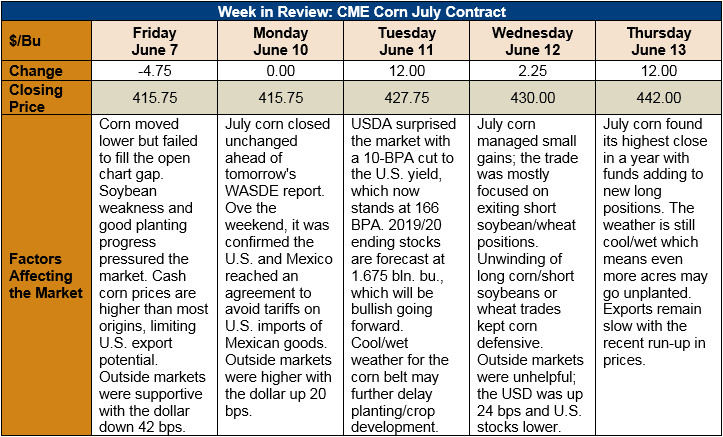

Outlook: July corn futures are 26 ¼ cents (6.3 percent) higher than last Thursday’s close as a bullish June WASDE and continued wet Midwest weather motivated funds to build long positions. The fundamentals are increasingly bullish for corn and wheat with the soybean forecast providing some support as well. Moreover, the weekend’s news that the U.S. and Mexico will remain on friendly trade terms helped support the corn market.

The biggest news of the week was Tuesday’s WASDE report. USDA lowered its forecast of the U.S. 2019/20 corn yield by 0.628 MT/ha (10 BPA) to 10.42 MT/ha (166 BPA). The new forecast was decidedly on the low end of analysts’ expectations and, when coupled with a 1.21 million-hectare (3 million acre) reduction in planted area, resulted in a strong move higher in the futures market. 2019/20 production forecasts were lowered 34.29 MMT (1.35 billion bushels) to 347.5 MMT (1.368 billion bushels).

On the demand side, USDA kept ethanol and food/seed/industrial use unchanged from the May WASDE but reduced feed and residual use by 7.62 MMT (300 million bushels). That reduction carried through to an equal reduction in total use. The agency’s ending stocks estimate fell 20.575 MMT (810 million bushels) to 42.547 MMT (1.675 billion bushels). The ending stocks-to-use ratio fell from 16.9 percent to 11.8 percent, prompting the agency to increase its farm price forecast to $3.80/bushel.

USDA did not make any changes to the 2019/20 oats, sorghum, or barley balance sheets, except for raising prices for each commodity. The average farm price for sorghum was increased from $3/bushel to $3.50 while the barley price forecast was revised upward from $4.20/bushel to $4.65. Oat prices were moved 30 cents higher from $2.60/bushel to $2.90.

On Monday, USDA noted 83 percent of the U.S. corn crop was planted. The statistics shows that the crop is still behind the five-year average pace of 99 percent but also that farmers made good progress last week. Sixty-two percent of the crop is emerged, behind the five-year average of 93 percent which could cause development concerns in the future. USDA noted 59 percent of the crop is rated good/excellent, slightly below the typical rating for this time of year.

From a technical standpoint, July corn futures are trending higher and posted a new high for their most recent rally. Cash prices are near multi-year highs while futures spreads are narrowing – two developments that suggest the rally is fundamentally-driven. Funds are adding new longs to their positions and commercial activity has been heavy as well. The outlook for corn is higher with both the fundamentals and technicals supporting this forecast.