Ocean Freight Markets and Spreads

Ocean Freight Comments

The U.S. forces and coalition members are gaining an upper hand on the Houthi’s terrorist organization by daily destroying drones, missiles and missile launchers this week. There were no reported attacks by the Houthi’s. Until there is a lasting calm, shippers and ocean vessel owners and operators are going to be wary of operating through the Red Sea and around the Arabian Peninsula. Until then commodities and goods dependent on those routes will be disrupted by elongated ocean logistics and tightened vessel capacity utilization.

Container freight rates to the U.S. from Asia appear to have peaked in the last week, not before the index for 40-foot equivalent containers pegged 8,000. The U.S. to Asia container rates are subdued, especially from the U.S. West Coast, but from the East Coast the container index is up 22% to an index of 564 through the most recent week.

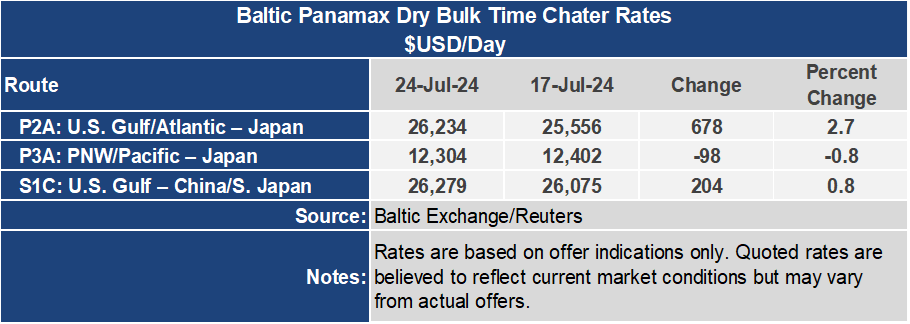

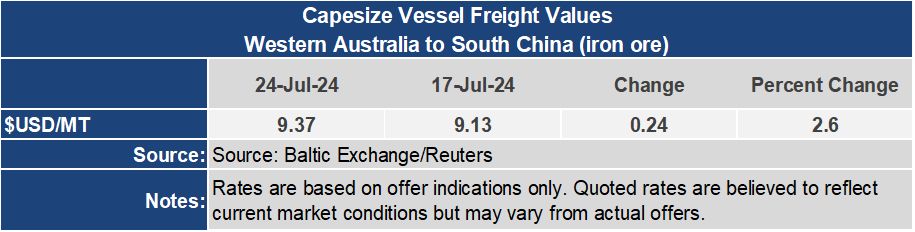

The Baltic Dry Index lost ground this past week, slipping 1.4% to an index of 1,864, which is 75% higher than levels one year ago. The BDI was pulled lower by the Capesize sector that ended the week down 4.7% to an index of 2,803, which is 61.6% higher than one year ago. The smaller vessel sizes were firm for the week. The Panamax sector gained 3% to an index of 1,765 for the week while being 92.7% above the level one year ago. The Supramax gained 1.1% for the week to 1,385 and is up 86.7% from one year ago.

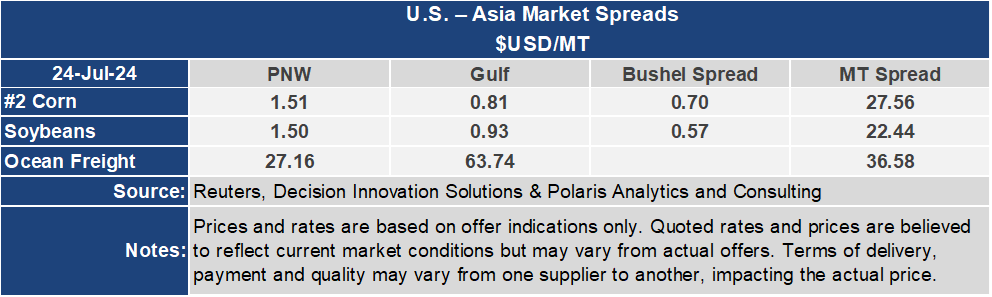

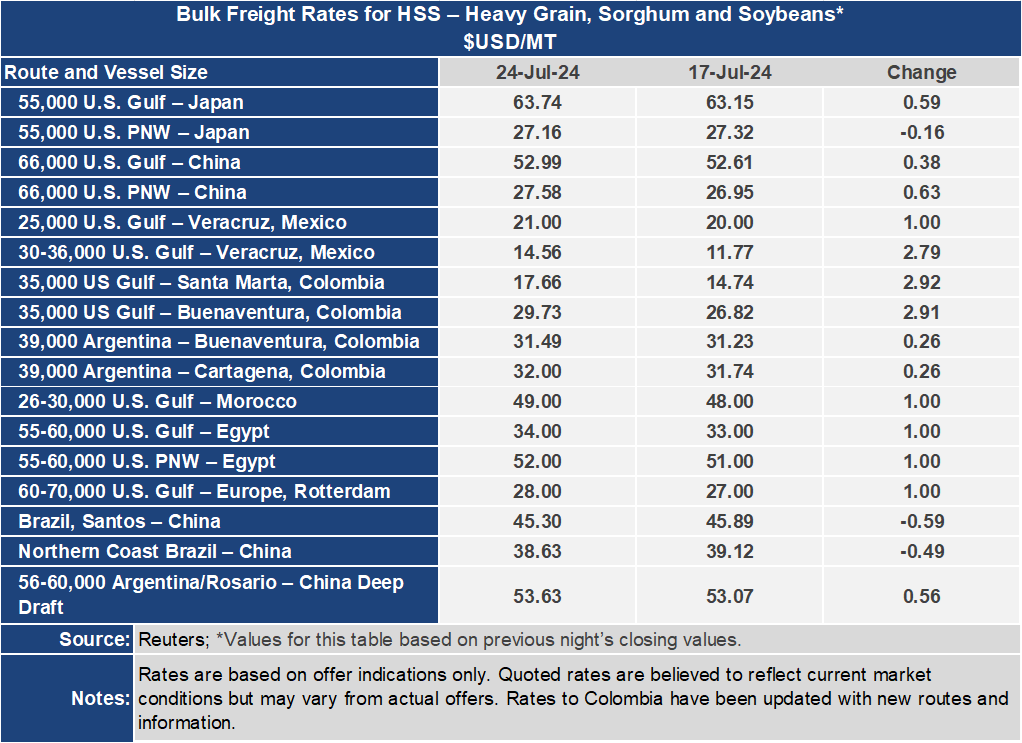

Out of the U.S. the key grain routes were firmly higher on most routes, following the strength of the Panamax and Supramax sectors. From the U.S. Gulf to Japan, the rate was up $0.59 per metric ton to 63.74 per metric ton for the week. Conversely, the rate from the Pacific Northwest to Japan was down $0.16 for the week to $27.16. The spread between these closely watched routes widened more than 2% or $0.75 per metric ton to $36.58 per metric ton. Other routes from the U.S. Gulf were firmer, especially to Mexico and Central America. Demand has been firm, offsetting crude oil prices that have been falling all of July, down nearly $4 per barrel to $81.19 per barrel this week, leading to lower bunker fuel costs.