Chicago Board of Trade Market News

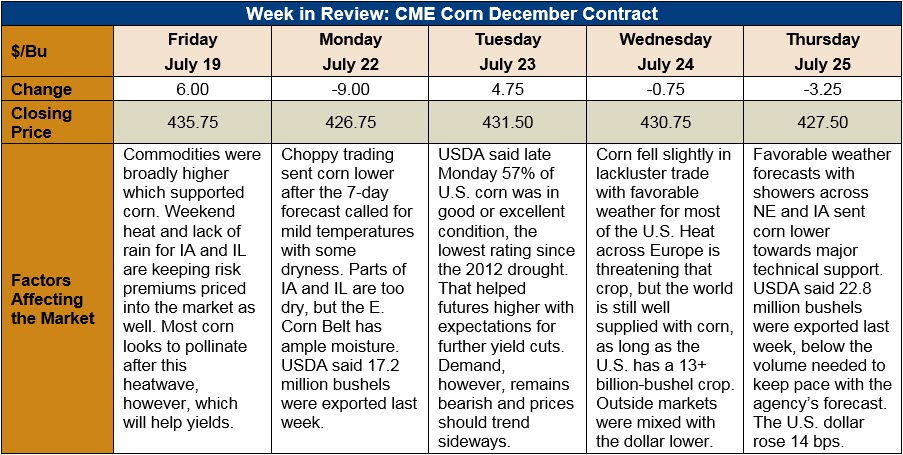

Outlook: December corn futures are down 8 ¼ cents (1.9 percent) this week as fresh fundamental news has been light in advance of the August WASDE and U.S. acreage reports. Bulls point to the likelihood of a smaller crop and yields as justifying higher prices while bears point to sagging demand as a market headwind. The market seems to have entered a holding pattern while the summer wears on and crops continue to mature.

On Monday, USDA said 35 percent of the U.S. corn crop was silking, well behind the five-year average pace of 66 percent. Fifty-six percent of the U.S. corn crop was rated as good or excellent condition, per the USDA, which is the lowest late-July rating since the 2012 drought. Yield potential has certainly been cut this year, but favorable weather forecasts for the coming 7-14 days should allow pollination to occur with minimal heat. If the weather forecast holds true, additional yield damage could be minimal.

USDA’s weekly Export Sales report noted that exporters sold 121,200 MT of net sales for the 2018/19 crop with weekly exports of 578,600 MT. The export figure was down 15 percent from the prior week and put YTD exports at 45.286 MMT (down 8 percent). YTD bookings (unshipped sales plus exports) are down 16 percent. Other highlights from the report include 54,500 MT of sorghum exports and 700 MT of barley exports. YTD barley exports are up 6 percent.

Cash corn prices are slightly lower across the U.S. as farmer sales have increased amid favorable weather forecast for the 2019/20 crop. The average U.S. cash price fell 1 percent to $4.17 this week but is 25 percent higher than this time in 2018. Barge CIF NOLA values are slightly higher at $190/MT while FOB NOLA corn values are 2 percent higher at $200/MT.

From a technical standpoint, December corn has largely entered a sideways trading pattern with major support at $4.20. Weather forecasts have an atypical impact on the futures market this year with hot/dry forecasts sparking significant CBOT rallies and favorable outlooks prompting pricing weakness. Funds still hold a 178,00-contract long position in corn futures and have been defending that position on market breaks. Additionally, commercial buying has been notable when futures have approached $4.25-4.30, which is further supporting the market. The outlook seems to be that corn futures will continue modest swings within their recent trading range until more is known about 2019 yields and acreage.