Chicago Board of Trade Market News

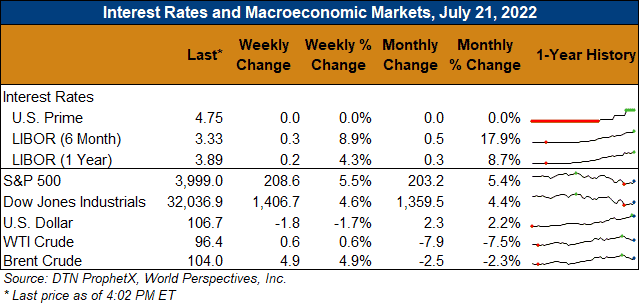

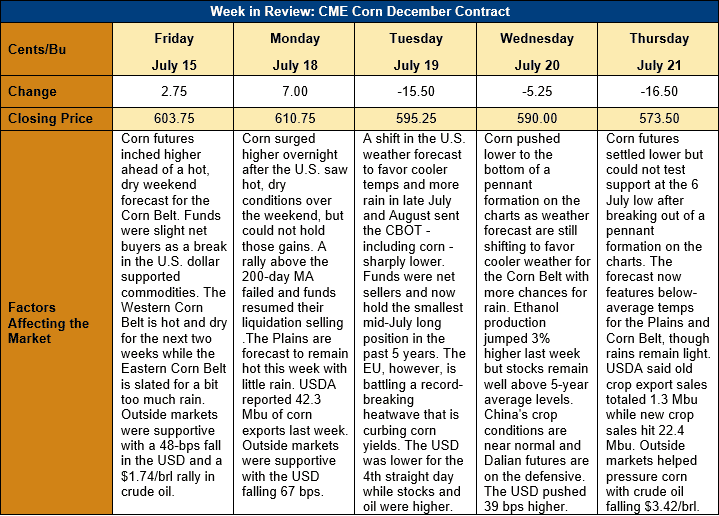

Outlook: December corn futures are down 30 ¼ cents (5.0 percent) this week a strong overnight rally Sunday night and Monday morning failed to find follow through support. A combination of improved weather forecasts for the U.S. Midwest and seasonal price patterns kept corn futures on the defensive.

Despite last week’s heatwave that blanketed much of the Plains and Western Corn Belt, U.S. corn conditions were steady last week. USDA estimated that 64 percent of the crop was in good/excellent condition, which was above expectations and in-line with the five-year average rating. Concerns had been mounting that the U.S. would experience a hot, dry finish to the month of July that could negatively impact the corn crop as it passed through pollination. Those fears were relieved somewhat this week as the weather forecast shifted to feature more rains for the northern Plains and Corn Belt along with cooler temperatures in August. Notably, 37 percent of the crop was silking last week, down from the 5-year average of 48 percent while just 6 percent had entered the dough stage (versus 7 percent on average).

The fact that the U.S. crop is developing in good condition with trendline or better yields should be a reassurance to the global market, especially as production in the EU and Ukraine is threatened. Western Europe is grappling with a record-breaking heatwave that is threatening the continent’s corn crop as it passed through critical growth stages. USDA’s July WASDE anticipated Europe would produce a 68-MMT corn crop with a yield of 7.5 MT/ha, but that figure is increasingly in question. Similarly, Ukraine’s 25-MMT corn crop (down from 43 MMT produced in 2021) is also threatened by hot temperatures and the impacts of Russia’s invasion of the country. Ukraine was expected to export 9 MMT of corn in 2022/23 (down from 36.2 MMT last year), but the war’s impacts could prove that figure overly optimistic.

The U.S. export market is well into its seasonal shift whereby old crop (2021/22) export sales decline as new crop (2022/23 sales increase rapidly. USDA reported that net old crop sales last week totaled 33.9 KMT (down 43 percent week-over-week) but new crop sales were up 64 percent at 570,000 MT. Old crop exports, however, rose 21 percent and totaled 1.109 MMT as buyers took advantage of the break in futures prices. YTD 2021/22 bookings total 60.45 MMT, down 13 percent, while new crop bookings total 7.4 MMT, down 54 percent from last year’s historic pace but in-line with the five-year average rate.

From a technical standpoint, December corn futures attempted to test their 6 July low on Thursday, 21 July. The market, however, found sufficiently robust end-user buying interest and short-covering that it was unable to test that technical support point. The market has been unable to post a new low since early July, which could suggest a near-term bottom is forming. Funds now hold their smallest long position in late-July in the past 5 years at a time when the EU crop is suffering a heatwave and U.S. weather forecasts only recently turned favorable. End-users have also been active buyers on this week’s break in new crop futures, which is supporting the cash market and creating a more stable outlook for prices heading into fall.