Ocean Freight Markets and Spreads

Ocean Freight Comments

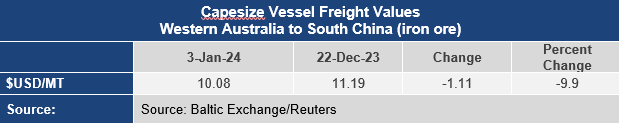

Dry bulk ocean freight rates ended 2023 retracing gains through early December. The Baltic Dry Index for example, the venerable measurement on the health of the dry bulk sector ended 2023 at 2,094, a drop of 37% from an eighteen-month peak of 3,346 on December 4. The decline is attributed to the wild swings of the Capesize market that saw demand collapse to haul iron ore and coal. The Capesize market greatly influences the Baltic Dry Index.

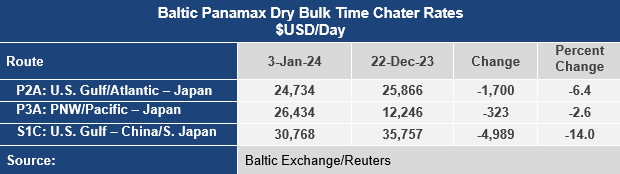

The smaller vessel classes finished the year lower as well with the Panamax market ending at an index reading of 1,909, nearly one-fourth off its early December peak and the Supramax sector ending at 1,369, which was 13% below the December peak.

Even though freight rates ended 2023 lower, they remain well above levels from one year ago, with the Baltic Dy Index two-thirds higher, the Capesize market more than double, while the Panamax and Supramax sectors ended about 30% higher.

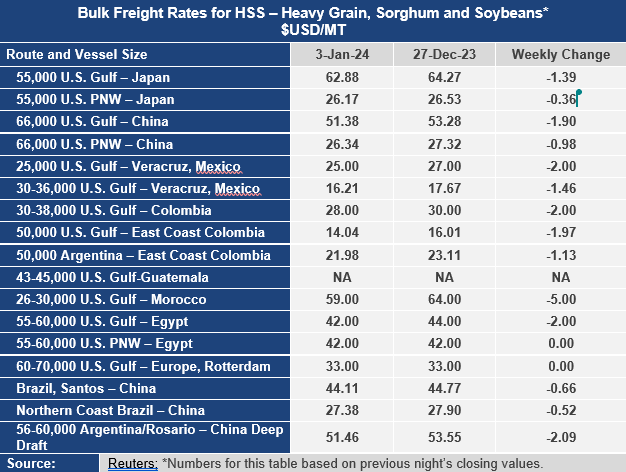

With 2023 in the rearview mirror, freight rates continue the pathway of lower levels with the Panamax market starting 5% lower at 1,808, the Supramax down 7% to 1,271 and the Handysize sector down 15% to 745.

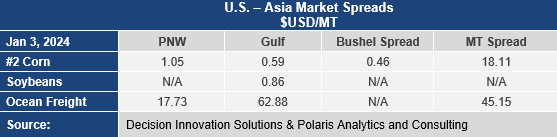

Ocean freight rates are demonstrating a weakness in demand despite bullish factors across the globe. For example, the Panama Canal continues to experience an El Nino induced drought leading to historic low water levels in Gatun Lake, the key reservoir used to flush vessels through the Panama Canal. The drought is not expected to let up anytime soon. The seasonal dry period continues until May. The Panama Canal Authority relaxed the number of daily transits from 18 (that was to go into effect February 1, 2024) to 24 vessels, but that is woefully below the 38 transits when navigation conditions are adequate. These fewer slots mean transit times between origins and destinations are longer, adding upwards of $0.50 per metric ton for grain each day a vessel is delayed locking through the Panama Canal. Or vessels take longer routes around the Cape of Good Hope or through the Suez Canal. For grain exports out of the United States routing volumes through the Pacific Northwest is a good alternative. The vessel draft is restricted to 44.0 feet through the Neopanamax locks, while unchanged at 39.5 feet through the Panamax or original set of locks.

Meanwhile, the Red Sea is fraught with attacks on merchant vessels plying the waters between Asia and the Mediterranean Sea, which requires transiting the Suez Canal. As such, vessel owners and operators have paused using that route out of safety concerns. Instead, vessels are being routed around the Cape of Good Hope, adding days and weeks to transit times. Those longer sailings lead to tightened vessel capacity utilization and higher freight rates while disrupting supply chains.

Freight rates could find upward price action on continued transit issues across Panama, increased terrorist activity in the Red Sea, improving global economic activity that demands more iron ore and coal, and shifts in grain and soybean flows between South America and the United States, depending on how crops progress in South America. For now, ocean freight rates have a sluggish start moving into the New Year.