Chicago Board of Trade Market News

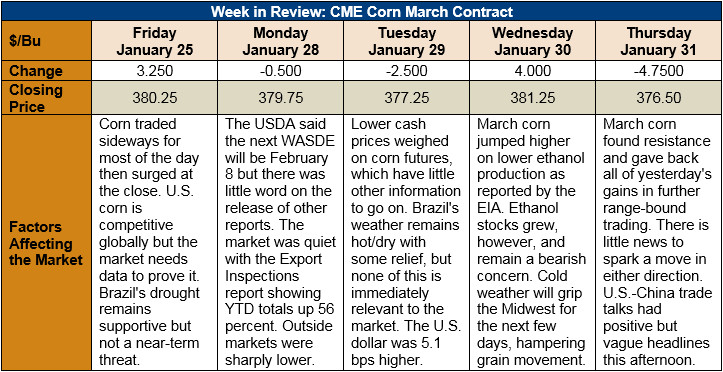

Outlook: March corn futures are heading sideways with little fresh news to spark movement one way or another. The contract is down 3 ¾ cents (1 percent) from last Thursday.

The arctic blast covering the U.S. Midwest this week is slowing grain transportation and logistics. The difficulty moving grain is partly responsible for this week’s higher cash prices (averaging $3.52/bushel, up 1 percent from last week). Prices this week are 6 percent higher than this time last year.

Today USDA released its export sales report for 20 December 2018. The report showed 1.717 MMT of gross sales and 0.899 MMT of exports. That data, now over a month old, showed 2018/19 YTD exports of 17.6 MMT, up 76 percent from the prior year. Now, the market will wait for USDA’s aggressive release of the other backlogged reports.

Monday’s Export Inspections report showed 0.893 MMT of corn exported, down 21 percent from the prior week. The volume was enough, however, to keep the YTD totals up 56 percent. The report also showed weekly sorghum exports of 7,197 MT.

In Brazil, the weather remains hot and dry which may impact the country’s second-crop corn, which is about to be planted. The situation is slightly concerning for the corn market with global supplies starting to tighten but remains a medium-term threat for now.

Technically, March corn futures are in a strictly range-bound, sideways trading pattern. The market has found near-constant support at $3.75 and resistance at $3.82/bushel. Without the weekly CFTC report, it’s impossible to know how funds are positioned, but the market’s widely-held belief is that funds are at least slightly long corn. Commercials have reportedly been active buyers on recent dips, but futures spreads do not reflect any shortage of corn this spring. Until more fundamental news is found, the market seems destined for more sideways trade.