Chicago Board of Trade Market News

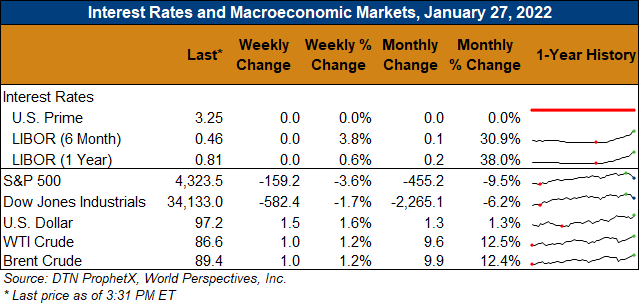

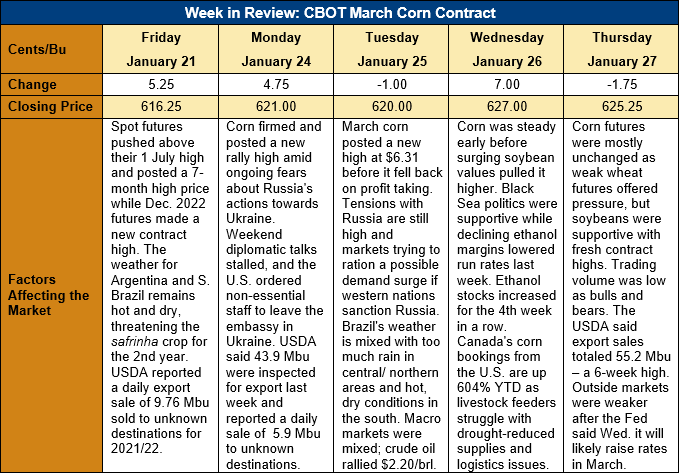

Outlook: March corn futures are 9 cents (1.5 percent) higher this week as U.S. exports, South American weather patterns, and geopolitical tensions in the Black Sea continue to provide a supportive backdrop. March futures posted a new high for their current rally and the highest settlement since the 7 May contract high as both speculative and commercial traders were “risk on” buyers. Other ag markets, notably wheat and soybeans, also offered support to corn futures and intracommodity spread trade furthered the corn market’s rally.

World grain markets strengthened during the past week in a preemptive, demand rationing move in case western governments placed grain trade-restricting sanctions against Russia. Over the weekend, diplomatic talks between Russia, Ukraine, and NATO stalled, which sparked another rally in European and U.S. grain markets early this week. Since Wednesday, political tensions have eased slightly, which sent CBOT wheat futures lower, but corn has maintained its strength. Still, Russia’s growing military presence on the Ukrainian border is keeping grain markets unnerved and prices reflect the geopolitical uncertainty.

South America’s weather and crop production prospects remain at the forefront of 2021/22 grain supply estimates. Argentina’s late-planted corn crop is silking as another heatwave arrives. The hot, dry conditions will further curb Argentina’s corn yield potential, as well as production prospects for the crop in southern Brazil. In contrast, heavy rains in central and northern Brazil are delaying the planting of the Brazilian safrinha (second-crop) corn. More concerningly, the long-term forecasts call for another round of hot, dry weather to hit central and southern Brazil in March, which could damage safrinha yields. South American weather patterns continue to suggest ample risks for crop production and are supporting cash and futures values.

U.S. corn exports are picking up with net sales growing 28 percent last week to 1.402 MMT. Weekly exports were up 11 percent at 1.436 MMT, putting YTD exports at 18.399 MMT (down 3 percent). YTD bookings (unshipped sales plus exports) now total 43.95 MT, down 10 percent from last year. Notably, Canada has booked 3.2 MMT of U.S. corn, so far this year, up 604 percent from this same time in 2020/21.

From a technical standpoint, March corn futures continue to trend higher and posted several bullish developments in the last week. The market pushed above resistance at $6.30 and forged its highest price since 10 June 2021 and scored the highest settlement since the contract high of 7 May 2021. The market continues to find support at successively higher levels, which is a key condition for a bullish market. Bull spreading indicates commercial demand for corn remains strong, especially with export demand increasing, and funds continue to add length to their positions. Should the market pull back, support lies initially at $6.15, followed by the 20-day moving aveage ($6.05), and then by trendline support at $5.94. Resistance lies at Wednesday’s high of $6.31 and at the contract high ($6.40 ½).