Chicago Board of Trade Market News

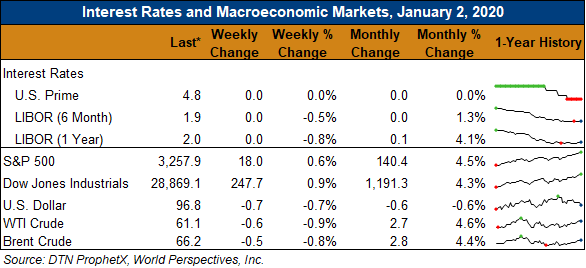

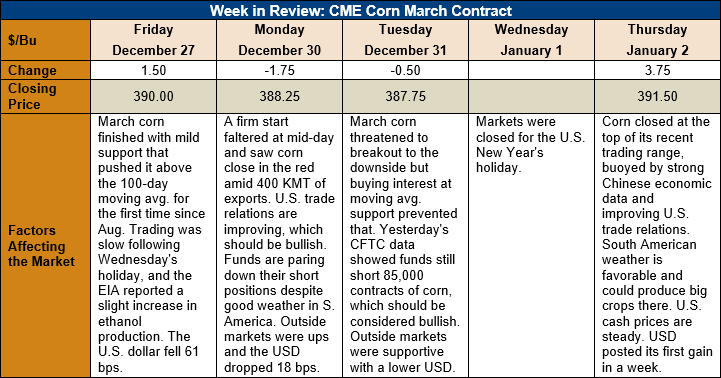

Outlook: March corn futures are 1.5 cents (0.4 percent) higher this week following generally quiet trade during the Christmas and New Year’s holiday weeks. The markets are mostly watching global export demand developments as well as keeping an eye on the South American weather. The USDA’s January WASDE report is expected to bring some modest adjustments to the world corn/feed grain balance sheets, including some possible reductions to U.S. ending stocks. For now, however, traders are adjusting positions while watching exports and weather forecasts.

The weekly Export Sales report is delayed until Friday, January 3 due to the New Year’s holiday but Monday’s Export Inspections report featured 408,000 MT of corn shipments, up 2 percent from the prior week, along with 4,000 MT of sorghum inspections. YTD corn shipments are 55 percent below last year’s levels while sorghum and barley inspections are up 90 and 171 percent, respectively.

Cash corn prices are steady this week with the average price across the U.S. reaching $146.10/MT. Basis levels have widened under an uptick in farm sales and a holiday-induced reduction in commercial buying interest. The U.S. average basis reached 20 cents under March futures this week. Barge CIF NOLA values are unchanged at $169/MT for spot positions while FOB NOLA offers are up 1 percent at $176.75/MT.

From a technical standpoint, March corn is once again range-bound with a ceiling at $3.92 and support at $3.85. The market is waiting for a fundamental shock to justify a move outside of this range, but fundamental changes are typically hard to find in January. Seasonally, the market should start a slow climb higher, but that extends partly on how much grain USDA says is in U.S. grain bins in its January reports as well as how exports perform going forward. With U.S. Gulf corn competitive against other international destinations, however, there seem to be good odds of a seasonal swing higher.