Ocean Freight Markets and Spreads

Ocean Freight Comments

Shipping activity or the lack thereof through the Red Sea continues to be a focused event. The Houthi’s are continuing to attack vessels transiting the region. Earlier this week two U.S.-owned and operated dry bulk vessels, one transporting steel and the other carrying phosphate rock, were attacked. The United States and British military are carrying out strikes against the Houthi attackers but lack a full coalition of other supporting countries to take a firm stand. The U.S. did reinstate the Houthi’s as “Specially Designated Global Terrorist.” Meanwhile war risk premiums are rising on vessels transiting the area. Premiums have reportedly risen to 1% of the vessels’ value, up from 0.7% over the past week. The situation is not expected any time soon and will likely escalate. Ship owners and operators are mixed on their actions, but many are choosing longer and more expensive sailing routes around the Cape of Good Hope of South Africa.

It is estimated that about seven million metric tons of grain are transported through the Suez Canal and the Red Sea each month. Given the attacks on vessels about 20% of those shipments are being diverted around the Cape of Good Hope, up from 10% nearly two weeks ago. Because of the attacks in the Red Sea, wheat shipments transiting the Suez Canal and Red Sea fell by almost 40% in the first half of January to 0.5 million metric tons, according to the World Trade Organization. The impacted shipments include wheat from Europe, rapeseed from Australia and soybeans from the United States. For U.S. grain exports, most shipments do not use the Suez Canal or Red Sea, rather the vessels carrying those exports transit the Panama Canal, are already sailing around the Cape of Good Hope, or through the Pacific Northwest for a direct transit across the Pacific Ocean to Asia. The U.S. has alternative routing options accessing global markets.

The water level of Gatun Lake in Panama has not changed much the past week, holding steady at 81.5 feet, about seven below normal for this time of year. Gatun Lake serves as an important reservoir to flush ships through the Panama Canal system of locks. The low water has led to a freshwater surcharge of 1.82%, limiting the number of daily vessel transits to 24, down from 36 during normal navigation conditions, and increased transit delays. This is Panama’s dry season that runs through May, so water levels are not anticipated to improve much until June.

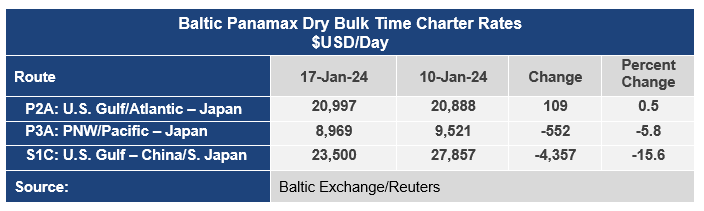

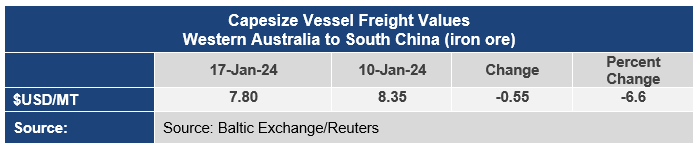

With this being the seasonal slow demand period for dry bulk freight vessels, rates are continuing to fall, with the Baltic Dry Index dropping 356 points or more than 21% this week to an index of 1,308. The dry bulk sector is being led lower ahead of the Chinese New Year that begins February 10, 2024, and officially ending on February 20, 2024. The dry bulk sector is being pulled lower by the largest class of vessels, the Capesize market that ended the week 36% lower to an index of 1,733. The smaller and more grain-focused sectors were lower but only slightly, with the Panamax market down 1% to 1,446 and the Supramax down 8% to 1,039.

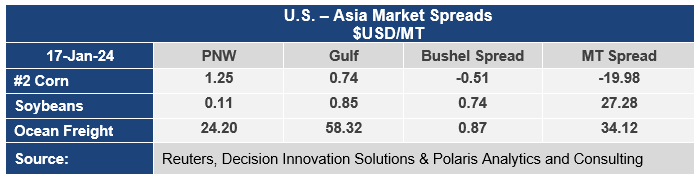

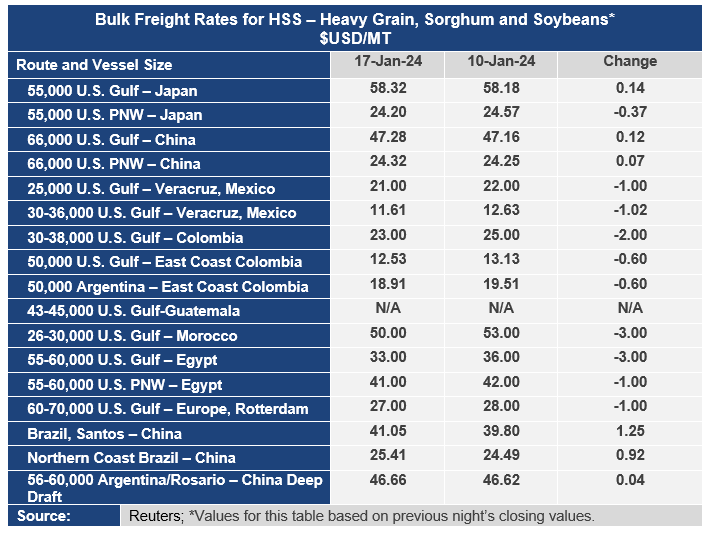

On a voyage rate basis, with demand for dry bulk vessel service weakening, and crude oil prices in a sideways trading pattern keeping bunker fuel prices in check, shipments out of the Center Gulf to Asia were slightly firmer this week as the rate to Japan ended the week at $58.32 per metric ton. Out of the PNW, the rate to Japan was down $37cents per metric ton to $24.27 per metric ton. The spread between these highly monitored routes widened $0.51 per metric ton to $34.12 per metric ton.

Navigation conditions on the lower Mississippi River through Memphis, Tennessee improved significantly this past week, jumping nearly 17 feet to a gage reading of 15.1 feet as of January 18, 2024. This is the highest reading since May 2023, and the first week above a zero-gage reading since mid-August 2023. These conditions assure adequate and improving opportunities to move grain and grain products by barge to export elevators located on the lower Mississippi River.