Chicago Board of Trade Market News

Outlook

USDA released the final production report for the 2023 U.S. production of corn, grain sorghum, barley, and soybeans. Both corn and soybean yields exceeded the highest expectations. WASDE estimates for production and ending stocks domestically and globally also exceeded trade expectations, particularly for world corn stocks. Domestic production estimates were not as far off as yield estimates, as WASDE also made unexpected cuts to total harvested acres. Changes to this year’s corn crop are what the market focused on in this report. The U.S. yield estimate was raised to 177.3 bu/ac. This is a new record yield for U.S. corn. Even with cuts to acres harvested this jump in yield raised production by 108 million bushels. Some offsetting increases in corn use helped keep the increase in ending stocks more moderate, but they were still raised 31 million bushels. U.S. domestic feed use was raised by 25 million bushels, and ethanol use by 50 million bushels. This caused annual average farm price forecasts to be lowered $0.05/bu. World corn ending stocks were raised by 10 million metric tons to 325.2 million metric tons. The supply-side news from these reports puts a negative cast over future price action, but the demand picture does offer some indications of increased usage. The focus for corn now turns to new demand news to drive the market price action with market watchers keeping an eye on southern hemisphere weather and crop prospects.

For soybeans, cuts to acres harvested were not enough to cover a significant increase to soybean yield, leading to higher total production. The new projected soybean yield would not be a record as two previous years have been higher: 2016 (51.9 bu/ac) and 2021 (51.0 bu/ac). However, with no increases in demand, ending stocks were raised 35 million bushels and the projected annual average farm price was lowered $0.15/bu. World soybean ending stocks were increased by 0.4 million metric tons.

The grain sorghum reports lowered U.S. production by 4 million bushels, lowered feed, seed & industrial use by 10 million bushels, and raised exports by 10 million bushels. Ending stocks for 2023/24 marketing year were lowered 4 million bushels to 22 million bushels. There was no change to the expected annual average farm price of $4.85 per bushel.

The USDA reports increased beginning stocks of barley by 8 million bushels, and made no changes to production or demand categories, thus ending stocks for 2023/24 were increased by 8 million bushels to 77 million bushels. The average annual farm price was raised by 10 cents to $7.50 per bushel.

Global coarse grain production for 2023/24 is forecast up 11.9 million tons to 1,513.9 million. This month’s foreign coarse grain outlook is for larger production, lower trade, and higher stocks. Foreign corn production is forecast higher with increases for China, India, and Paraguay partly offset by a decline for Brazil. China corn production is raised to a record 288.8 million tons based on the latest area and yield data from the National Bureau of Statistics. India corn production is raised on higher area. Brazil corn production is cut reflecting lower second crop corn area expectations.

Major global coarse grain trade changes for 2023/24 include increased corn exports for Turkey, but reductions for Brazil and India. Corn imports are raised for Iran, Iraq, and Turkey but reduced for the EU, Bangladesh, and Vietnam. Sorghum exports are raised for the United States, with higher imports projected for China. China’s corn feed and residual use is raised based on a larger crop. Foreign corn ending stocks are higher, mostly reflecting an increase for China partly offset by a decline for Brazil.

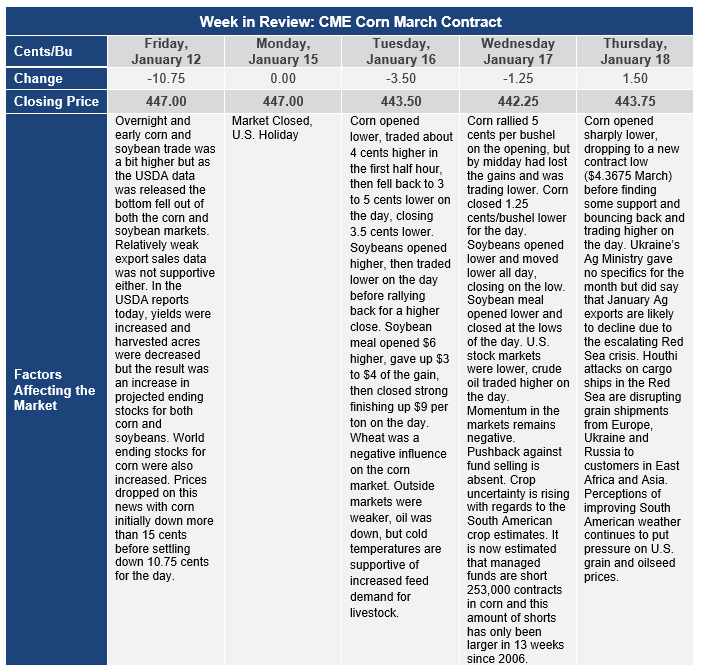

Corn prices moved lower this week, dropping 20 cents per bushel and making new contract lows at $4.3675 (March) before finding some support but still losing 14 cents per bushel for the week.