Chicago Board of Trade Market News

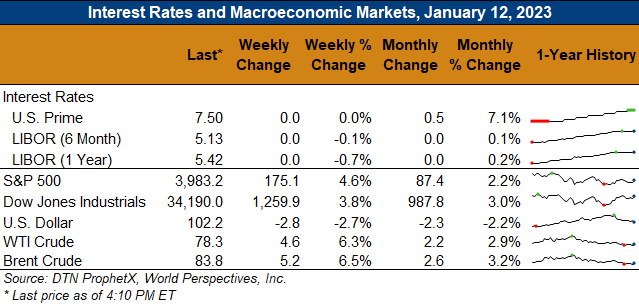

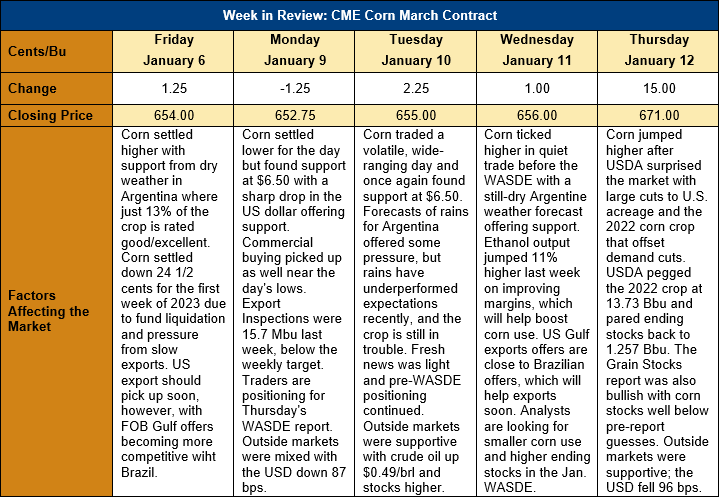

Outlook: March corn futures are up 17 cents (2.6 percent) this week as lackluster early-week trade gave way to a rally following a bullish January WASDE. USDA surprised the market with larger-than-expected cuts to 2022/23 U.S. corn production that outweighed reductions in consumption. The quarterly Grain Stocks report also featured a bullish surprise with less corn in bins than the market expected. Managed money funds had been slowly liquidating some of their long holdings in corn but returned as buyers following the reports.

USDA’s Grain Stocks report featured a 7 percent year-over-year decline in total corn stocks. The 274.3-MMT (10.8-Bbu) figure was below pre-report expectations of 284.17 (11.187 Bbu). The report also featured 4.07 MMT (160.2 Mbu) of sorghum stocks, which were down 45 percent from the prior year. Notably, on-farm sorghum stocks declined 40 percent from last December while off-farm stocks fell 45 percent. Barley stocks on 1 December 2022 were up 17 percent from the prior year at 353 KMT (16.2 Mbu) and oat stocks totaled 827 KMT (53.6 Mbu), down 3 percent year-over-year.

One of the biggest surprises in the January WASDE was USDA’s cuts to U.S. harvested area. USDA shaved off 1.98 Mha (1.6 million acres) from its harvested area estimate, putting the final figure at 32.06 Mha (79.2 million acres). Even though the agency increased its yield estimate by 0.58 MT/ha (1 bushel per acre), the lower harvested are pared the 2022 corn crop down 5.08 MMT (200 Mbu) to 348.76 MMT (13.74 Bbu).

The Grain Stocks report helped inform some aspects of the corn balance sheet’s demand items, and based on that information USDA shaved off 64 KMT (25 Mbu) from its feed and residual use estimate. The agency also cut 3.81 MMT (150 Mbu) from the U.S. export forecast, which is now projected to reach 48.9 MMT (1.925 Bbu) in 2022/23. The ethanol use of corn estimated was left unchanged but USDA cut 25 KMT off FSI use due to “reductions in corn used for starch and glucose and dextrose”. In total, USDA pared back total corn use by 4.7 MMT (185 Mbu).

The net impact of these changes is that U.S. corn supplies were cut by a larger volume than was consumption, leaving smaller ending stocks for 2022/23. The ending stocks figure now stands at 31.55 MMT (1.242 Bbu), which is down 9.8 from the prior year and in-line with 2020/21 carry-out. USDA left its forecast of the season average farm corn price unchanged at $263.77/MT ($6.70/bushel).

Outside the U.S., USDA lowered world corn production by 5.9 MMT and cut global 2022/23 carry-out by 2 MMT. The production declines were motivated by reductions in Argentina and Brazil that were only partly offset by a larger crop in China. USDA cut the Argentine corn crop by 3 MMT due to the ongoing drought and pared back its projection of the Brazilian crop by 1 MMT due to increasing dryness in key producing regions. The Argentine crop is now forecast at 52 MMT with some private analysts issuing forecasts below that figure, and Brazilian is forecast to produce 125 MMT in 2022/23.

From a technical standpoint, March corn has spent much of the new year establishing support near $6.50 and rallied from that level following the January WASDE. Basis and commercial buying remain strong, which are signals of underlying market support. Following the January WASDE, March corn tested resistance at the 100-day MA but could not move above it, making that point the next upside target for bulls. Above that, trendline resistance lies at $6.79 while support lies at $6.50, $6.35 (the 7 December daily low) and $6.11 ½ (the 25 November daily low) below that.