Ocean Freight Markets and Spreads

Ocean Freight Comments

While there are bullish features in the ocean freight markets, not all vessel types reflect such realities. Container freight rates are strengthening while dry bulk rates are weakening. As an example of this, according to Xeneta, container rates to the U.S. Center Gulf, specifically to Houston, Texas have surged to $US 3,979 per forty-foot container (FEU), which is 71% above the all-time low in April 2023. Container rates are higher as container lines are avoiding two key shipping lanes. One, they are constraining or halting transits through the Red Sea due to on-going terrorist attacks. And two, they are reducing or avoiding the Panama Canal due to persistent drought and low water conditions in Gatun Lake. Instead, carriers are opting to use longer routes around the Cape of Good Hope, nearly doubling transit times, or for U.S. cargoes, shift movements through the U.S. West Coast ports and use the rail landbridge to move containers to and from the hinterland. The higher rates are reflecting higher vessel utilization levels of days at sea.

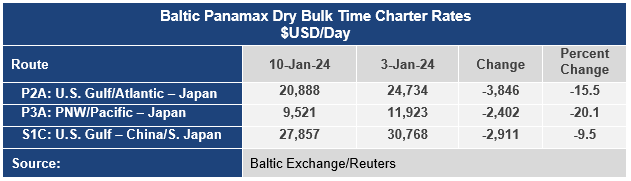

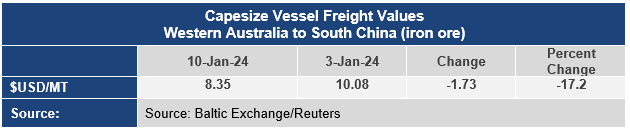

Despite the issues through the Red Sea or Panama Canal, dry bulk freight rates continue to fall, with the Baltic Dry Index dropping 427 points or more than 20% this week to an index of 1,664. The dry bulk sector is being led lower on seasonally slow shipments, especially ahead of the Chinese New Year that begins February 10, 2024, and officially ending on February 20, 2024. The dry bulk sector is being pulled lower by the largest class of vessels, the Capesize market that ended the week 25% lower to an index of 2,696. The smaller and more grain focused sectors were lower as well with the Panamax market down 19% to 1,464 and the Supramax down 11% to 1,135.

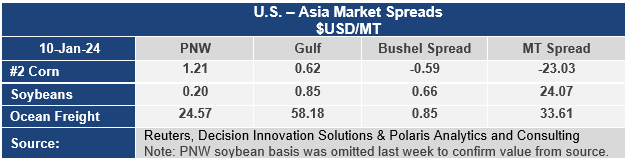

The dry bulk sector is less impacted by the terrorist activities in the Red Sea since about 4% of global dry bulk cargoes transit that region to access the Suez Canal and Mediterranean Sea. However, sailings of grain out of the Center Gulf to Asia that would go through the Panama Canal are taking the long route around the Cape of Good Hope or cargoes are being shifted through the U.S. Pacific Northwest.

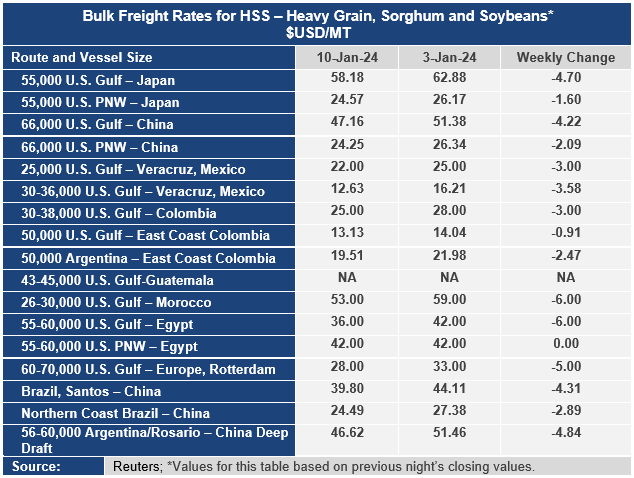

On a voyage rate basis, with demand for dry bulk vessel service weakening, and crude oil prices in a sideways trading pattern, which has kept bunker fuel prices in check, shipments out of the Center Gulf to Asia were down more than $4 per metric ton this week as the rate to Japan settled at $58.15 per metric ton for the week. Out of the PNW, rates did not fall as much but were lower nonetheless with the rate to Japan down $1.60 per metric ton to $24.57 per metric ton. The spread between these venerable routes narrowed $3.30 per metric ton or 8.5% to $33.61 per metric ton.

Navigation conditions on the lower Mississippi River through Memphis, Tennessee have improved, but remain below the zero-gauge reading at -1.8 feet as of January 11, 2024. One month ago, the gauge was at -6.5 feet. The negative reading has been a prolonged affair since August 2023. The U.S. Army Corps of Engineers has kept the key navigation channels dredged to allow barges and cargoes to move along the Mississippi River System. Over the next thirty days, the Corps anticipates that enough rain will recharge the system to see the Memphis gauge firmly rebound into positive territory. However, a polar vortex is moving into and across the United States and that could limit the volume of water finding its way into the navigation channels and limiting how much the gauge could improve.