Chicago Board of Trade Market News

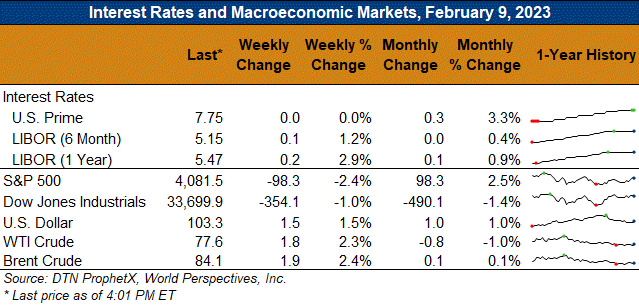

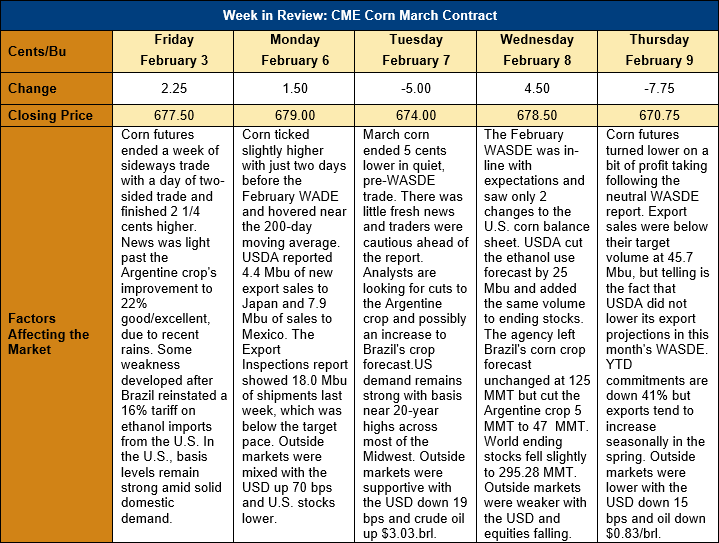

Outlook: March corn futures are down 6 ¾ cents (1.0 percent) this week as the market traded sideways heading into the February WASDE report on Wednesday. The report was broadly in-line with expectations and the expected cuts to the South American corn crop helped futures strengthen after its release. The report, however, was neutral futures across multiple commodities and the lack of a bullish story sparked profit taking and long liquidation on Thursday. With the report now in the past, the market is looking ahead to U.S. export potential as well as the spring 2023 planting effort.

USDA made few changes to the U.S. corn balance sheet in its February WASDE and instead made bigger updates to international crops. USDA cut its outlook for U.S. ethanol use of corn by 0.64 MMT (25 Mbu) with the new forecast of 133.36 MMT (5.25 Bbu). That consumption decrease flowed directly to the ending stocks estimate, which grew an equal amount to 32.18 MMT (1.267 Bbu). The USDA left its forecast of the season-average cash farm price unchanged at $263.77/MT ($6.70/bushel) despite the fractional increase in carry-out.

On the international stage, the market was eagerly expecting USDA’s assessment of the Brazilian and Argentine crops, given the drought across Argentina and southern Brazil. USDA did not alter is prior forecast of the Brazilian crop and left the estimate at 125 MMT, which was in-line with pre-report expectations. The agency did increase its forecast of Brazil’s exports to 50 MMT, up 3 MMT from the January assessment. For Argentina, however, the USDA saw strong impacts from the ongoing drought. The Argentine corn crop was pegged at 47 MMT, down 5 MMT from the January WASDE and 1 MMT below the average pre-report estimate. Argentina’s corn export forecast for 2022/23 was cut 3 MMT to 35 MMT, which could send additional demand to the U.S., especially as the market awaits the Brazilian safrinha crop’s arrival in May/June.

The weekly Export Sales report featured net sales of 1.16 MMT, which was down 27 percent from the prior week’s above-average volume. U.S. exporters shipped 0.394 MMT last week (down 34 percent week-over-week),which put YTD exports at 13.05 MMT. YTD exports are down 37 percent while YTD bookings (exports plus unshipped sales) are down 41 percent at 26.792 MMT. Corn exports typically increase in March through May, and it is notable that, despite the current export pace, USDA did not lower its U.S. corn export forecast in the February WASDE.

Technically, March corn futures are still trending higher with trendline support at $6.61. The market has, however, hit resistance near $6.90 in recent weeks, which has turned the rally sideways. Thursday’s trade was weaker, but the market found support at $6.70 – one penny above the 40-day moving aveage. In recent weeks, international traders have become active buyers on breaks in corn futures and that trend is likely to continue heading into March.