Chicago Board of Trade Market News

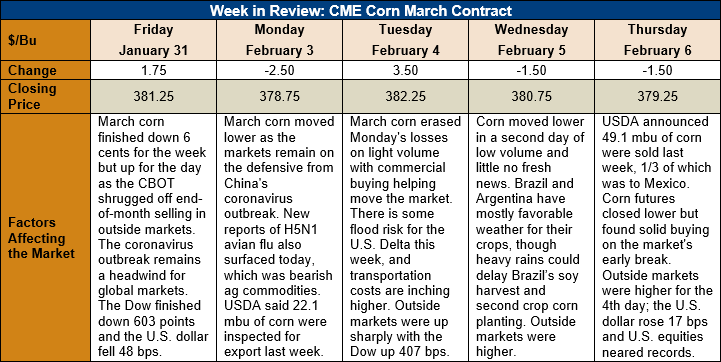

Outlook: March corn futures are 2 cents (0.5 percent) lower this week as global markets have regained some strength following encouraging developments about treatments for the coronavirus. The corn market has mostly moved sideways this week with fresh news becoming somewhat hard to find. Last week’s CFTC report showed funds were held a slightly short but nearly neutral position in corn, and this week’s sideways trade likely reflects that reality. The trade is looking forward to next week’s WASDE report from the USDA that will offer a fresh look at U.S. demand prospects as well as South American supplies.

The weekly Export Sales featured 1.265 MMT of gross sales of corn while exports totaled 599,000 MT, a slight increase from the prior week. YTD exports now stand at 11.1 MMT, down 42 percent from the prior year. Other report highlights include 25,500 MT of sorghum exports and 1,200 MT of barley shipments. YTD exports for sorghum and barley are up 125 and 17 percent, respectively.

Cash corn prices are mostly steady this week with the national average price reaching $144.65/MT. Basis has weakened slightly and now averages 12 cents under March futures. Barge CIF NOLA prices are down 1 percent this week while FOB NOLA offers are steady at $176.75/MT. U.S. corn remains among the cheapest available origins globally, which should continue to support U.S. exports.

From a technical standpoint, March corn has stayed within its new trading range and has consistently found support as it nears the bottom of the range. Futures spreads are starting to widen as basis levels soften. Traders are also watching the ratio between the November soybean and December corn futures, which is an often-used indicator of farmers’ financial incentives for planting one crop or the other. The spread had contracted significantly to heavily favor corn acres but has since recovered as corn spreads widened. The USDA will offer its early outlook for 2020 plantings in it annual February outlook forum later this month. While USDA’s numbers often change significantly after that report, it is always interesting to hear the agency’s first forecast of what supplies might be in the coming year.