Chicago Board of Trade Market News

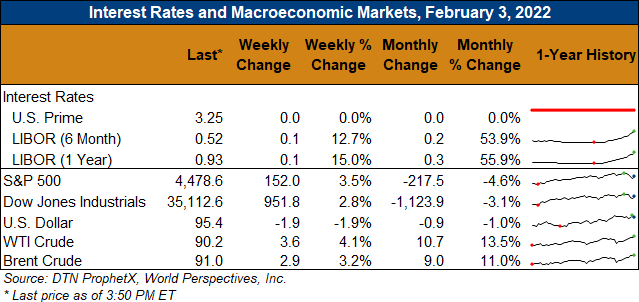

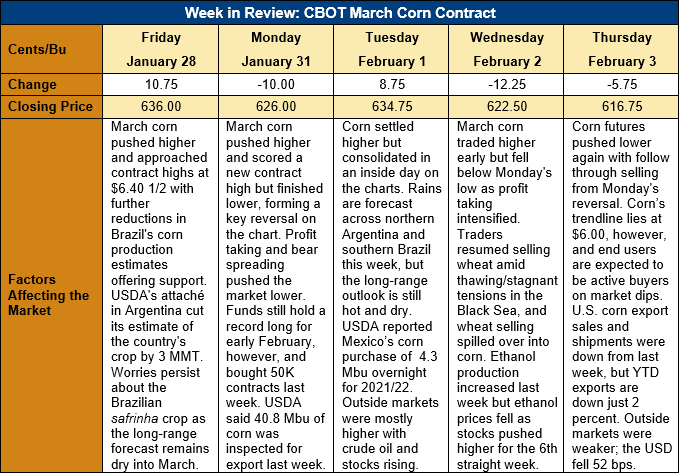

Outlook: March corn futures are 9 cents (1.5 percent) lower this week as profit taking, bear spreading, and some position liquidation developed after futures posted new lifetime highs on Monday. Fresh news has been lacking recently with political tensions in the Black Sea thawing, at least temporarily, which is causing futures markets to remove some premiums bid into prices. The Lunar New Year holiday celebrations are in full swing across China and Asia this week, which is slowing some trade activity.

Corn futures saw mid-week pressure develop from weather forecasts predicting beneficial rains for southern Brazil and northern Argentina this week. The added rains will benefit Argentina’s late-planted corn crop and will boost sowing conditions for Brazil’s second-crop corn. Long range weather forecasts, however, show increasing dryness for Argentina and southern Brazil beyond mid-February. Last year, heat and dry weather in Brazil during February and March decimated the safrinha crop and markets are consequently on edge this year amid persistent drought in Argentina.

International buyers booked 1.175 MMT of net corn sales last week, down 16 percent from the prior week. For the week ending 27 January, the U.S. shipped 1.166 MMT of corn for export, down 19 percent. Still, YTD exports are down just 2 percent at 19.565 MMT. YTD bookings (unshipped sales plus exports) are down 20 percent at 45.123 MMT, though some of the decrease is explained by abnormally large net sales that occurred during this time in 2021.

The Export Sales report featured 123,000 MT of sorghum exports, putting YTD exports at 2.086 MMT (down 23 percent). YTD sorghum bookings, however, are up 7 percent at 6.216 MMT. U.S. exporters also shipped 900 MT of barley last week.

From a technical standpoint, March corn futures posted a bearish reversal on Monday and seem to be following through on that signal for now. Notably, however, the contract has trendline support near $5.98 as well as psychological support at $6.00 that are likely to restrain any further weakness in futures. Moreover, commercial and end-user buying is likely to pick up as futures approach the $6 mark, as previous breaks to $5.90-6.00 have been seen “bargain buying” opportunities. The current pullback from contract highs looks like a temporary correction from overbought market conditions. If trendline support holds, the market will continue its seasonal grind higher amid a fundamentally supportive backdrop.