Chicago Board of Trade Market News

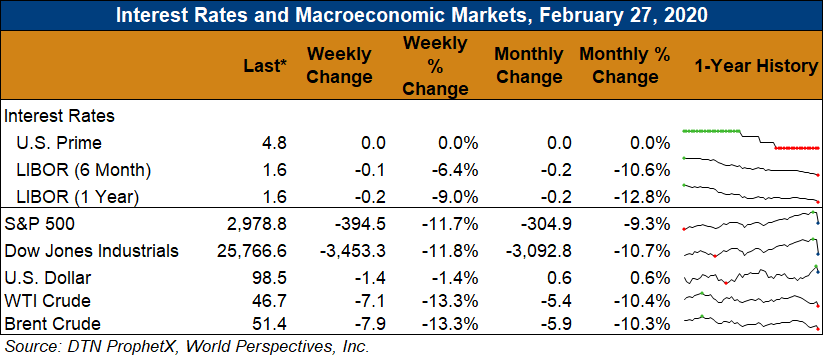

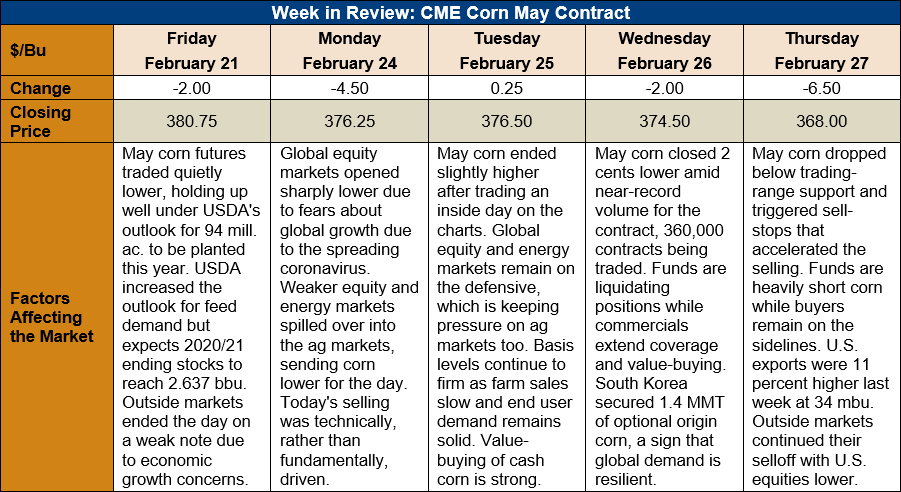

Outlook: May corn futures are 12 ¾ cents (3.3 percent) lower this week as global markets remain under pressure from concerns about global economic growth and commodity consumption. The coronavirus outbreaks were the catalyst for the drop in global equity markets, and subsequent “risk off” trade and position liquidation has impacted commodity markets as well. Fundamentally, little has changed this week regarding the outlook for corn supply and demand, but technical selling and declining risk appetites have pressured the futures market.

One of the biggest reassurances for global corn consumption and demand are the recent large purchases made by South Korea. That country this week secured 1.4 MMT of optional origin corn, which analysts believe will include U.S. product among other origins. U.S. corn exports increased 11 percent this week from the previous, reaching 844,000 MT according to USDA’s latest Export Sales report. Gross sales this week hit 956,000 MT, bringing YTD bookings (exports plus unshipped sales) to 25.8 MMT. The report also featured 444,000 MT of sorghum net sales and 2,300 MT of sorghum exports. Sorghum bookings are up 124 percent YTD and are helping basis values at the Gulf move higher.

Cash corn prices are down 2 percent from last week, finding better support that the futures market with strong commercial buying and rising basis levels. Lower futures values have slowed farmer selling in the U.S., leading end users to increase bids to procure product. Basis narrowed to 9 cents under May futures, up from 16 cents under May futures last week. Barge CIF NOLA corn values are 4 percent lower at $162/MT with improving river navigation helping ease prices. FOB NOLA values are down 3 percent at $170.50/MT for spot shipment.

From a technical standpoint, May corn futures have broken out of their sideways trading range to the downside with funds liquidating positions and bear spreading corn/soybeans. Managed money traders are thought to hold a net short position of 160,000 contracts, including options. The size of that short will be a bullish factor when “risk off” trading ends and the market again focuses on the fundamentals, which will lead to significant short covering. The corn market is approaching technically oversold levels with the relative strength index (RSI) at 36, meaning a correction higher could come soon. Additional fundamental support is likely to appear from an uptick in exports with U.S. corn becoming increasingly competitive on the world market.