Chicago Board of Trade Market News

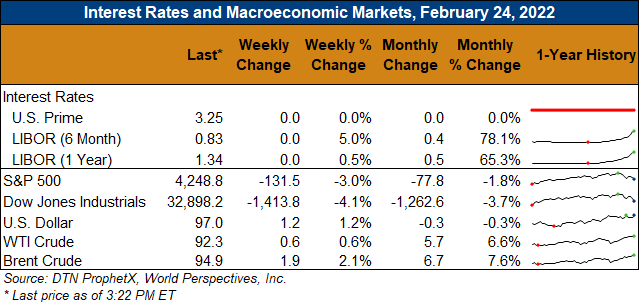

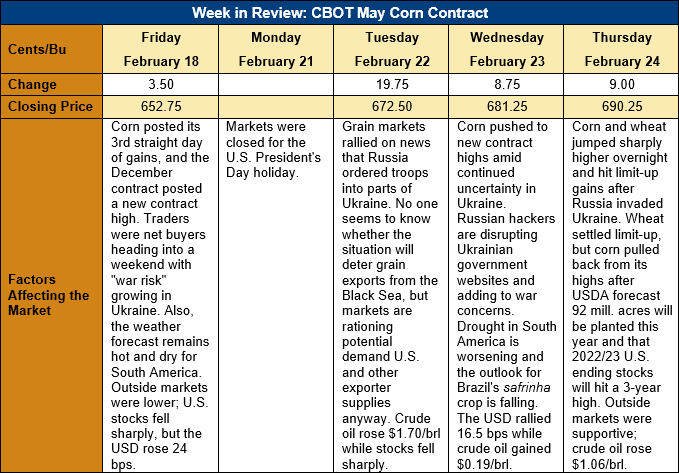

Outlook: May corn futures are 37 ½ cents (5.7 percent) higher this week after Russia invaded Ukraine. Ukraine, a significant grain exporter that was expected to ship 57.5 MMT of corn and wheat combined this year, shut its export ports early Thursday morning following the invasion. The threat to global exports sent wheat and corn futures higher both leading up to the invasion and in the first trading day since. Old and new crop corn and wheat futures all posted new contract highs on Thursday, with the May corn contract trading to $7.16 ¼ at the day’s peak. For corn, both old and new crop futures pulled back from the day’s limit-up highs with May corn settling 9 cents higher and September corn ending 8 cents lower.

Looking forward, the only thing that seems certain is that markets will remain volatile. Markets are trying to price the significant uncertainty created by the invasion, and “war risk” premiums are present in grain prices, currency exchange rates, and freight rates. Grain bulls point to the odds of a protracted conflict in Ukraine disrupting farming and grain export operations, while bears remember that the 2014 annexation of Crimea left grain shipments largely unhindered. Only time will tell which viewpoint is correct.

The USDA’s annual Ag Outlook Forum is underway this Thursday and Friday and offers the agency’s first look at the 2022/23 U.S. crop balance sheets. The headline numbers were the forecast that farmers will seed 37.23 million hectares (92 million acres) of corn and 35.29 million hectares (87.2 million acres) of soybeans in 2022. USDA’s estimates were below pre-report expectations for both crops. For corn, USDA projected a 2022 yield of 11.38 MT/hectare (181 bushels/acre), which would be record-large if realized. The agency initially pegged the crop at 387.12 MMT (15.24 billion bushels), which would again be a record figure if realized.

On the demand side, USDA is largely looking for 2022/23 to be similar to the current projections for 2021/22 consumption. Feed and residual use were forecast equal with 2021/22 while ethanol use increased by 1.9 MMT (75 million bushels). Exports were forecast down slightly from 2022/23 at 59.693 MMT (2.35 million bushels) due to “expectations of increase competition…despite global trade growth.” Ending stocks were estimated at 49.914 MMT (1.965 billion bushels), which would be a 3-year high and put the ending stocks-to-use ratio at 13.2 percent, up from 10.4 percent forecast for 2021/22. The larger carry-out prompted USDA to lower the season-average farm price to $196.84/MT ($5.00/bushel).

The weekly Export Sales report from USDA is delayed due to Monday’s U.S. holiday, but the Export Inspections report featured 1.58 MMT of corn shipments this week. The inspection volume was 8 percent above the prior week and in-line with the seasonal increase in shipments. YTD corn inspections total 21.6 MMT, down 11 percent. The report also featured 257 KMT of sorghum inspections, up 41 percent from the prior week with China taking 255 KMT of the inspections. The rest was destined for Mexico.

From a technical standpoint, March corn futures are trending higher and posted new contract highs each of the past three days. The fact that the market settled 26 cents below its high and near the bottom of the day’s trading range on Thursday suggests some of the bullish momentum may be waning, however. The market is approaching overbought levels and may need to pullback in corrective trade. Moreover, the recent strength in the U.S. dollar (created by global investors moving money into “safe haven” assets) will impact U.S. export pricing and competitiveness on a relative basis. Trendline support lies initially at $6.53, followed by long-term trendline support at $6.15 ¼.