Chicago Board of Trade Market News

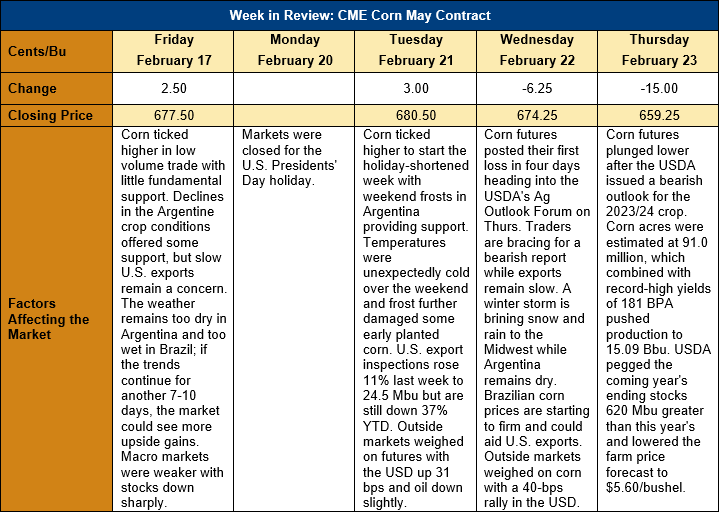

Outlook: May corn futures are down 18 ¼ cents (2.7 percent) this week with most of those losses coming on Thursday’s 15-cent plunge lower. The catalyst for the day’s weakness was bearish corn numbers from the USDA in the agency’s Agricultural Outlook Forum. Before Thursday’s numbers, the market had found support from dry weather and recent frosts in Argentina as well as somewhat unwelcome wet weather in Brazil. With USDA’s latest outlook shifting decidedly bearish, however, the market turned lower in heavy volume.

The USDA’s outlook forum saw the agency pegged 2023 U.S. corn plantings at 36.827 million hectares (91.0 million acres), which was above the pre-report estimate of 336.665 Mha (90.6 million acres). While the acreage number was slightly above expectations, it was the record-large yield projection of 11.37 MT/ha (181 bushels per acre) and production estimate of 383.31 MMT (15.09 billion bushels) that really pressured markets. The agency’s 2023/24 ending stocks forecast came in at 30.151 MMT (1.187 billion bushels), up 15.75 MMT (620 million bushels) from 2022/23.

The weekly Export Sales report is delayed one day due to this week’s federal holiday in the U.S. The export inspections report, however, showed an uptick in shipments, which rose 11 percent to total 622 KMT. YTD inspections are down 37 percent at 13.734 MMT. Last week also saw a surge in sorghum inspections, which totaled 71.8 KMT. Shipments to China accounted for 70.7 KMT of the volume.

U.S. cash prices are still historically strong with basis averaging 8K (8 cents over May futures) across the Midwest. This week’s basis is steady with last week and remains near 20-year highs in parts of the country. The average basis is well above the -18K recorded this time last year. U.S. Midwest corn prices average $268.47/MT ($6.82/bushel) this week.

Technically, May corn futures posted a bearish day on the charts Thursday with a break below trendline support at $6.64. The market also broke through support at the 50-day MA, which previously stalled selloffs earlier in 2023. Now, the market is targeting support near the early January congestion zone lows at $6.48-6.50 with the 7 December daily low providing support below that.