Chicago Board of Trade Market News

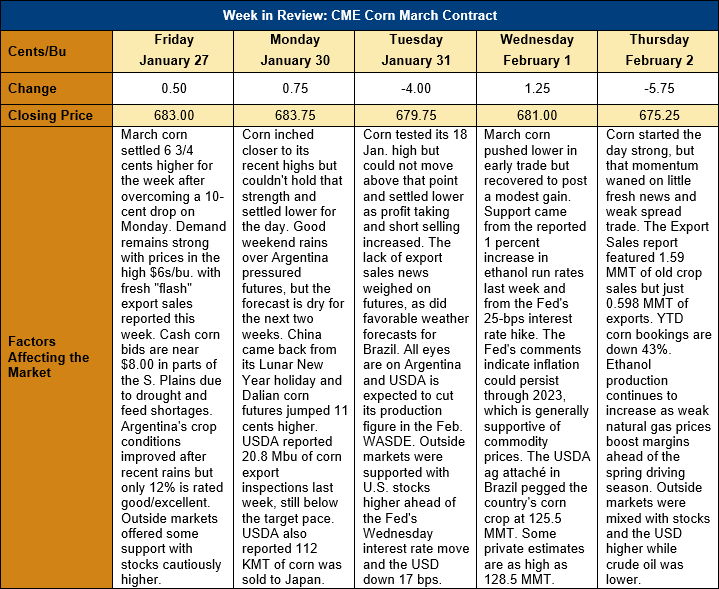

Outlook: March corn futures are down 7 ¾ cents (1.1 percent) this week as the market’s inability to move above the 18 January daily highs sparked profit taking and some selling pressure. Fresh fundamental news has been tough to find this week, leaving the South American weather/production potential and U.S. export trends to exert an outsized impact on CBOT futures.

Recent rains in Argentina have boosted corn conditions and the Buenos Aires Grain Exchange said 22 percent of fields were rated good/excellent. Even so, most firms are still predicting a crop between 42-46 MMT, which would be well below USDA’s January WASDE forecast of 52 MMT. The recent rains have taken out some of the “weather premium” from CBOT futures, but traders are still cautious about becoming overly bearish with Argentina’s two-week forecast turning dry. Further deterioration in the Argentine crop could boost U.S. exports, which tend to seasonally increase in March-May.

While Argentina continues to battle drought, Brazil is facing widely favorable growing conditions, except for dryness in Rio Grande do Sul. Estimates of Brazil’s total corn crop continue to inch higher with one private firm predicting a 128.5-MMT crop for 2022/23. There is still plenty of risk facing the crop, however, as the safrinha (the second-crop corn) planting effort has yet to begin. The safrinha crop accounts for approximately 80 percent of Brazil’s annual corn production.

U.S. corn export sales were strong last week and totaled 1.714 MMT, up 75 percent from the prior week. Weekly exports of 0.598 MMT were down 34 percent from the prior week and put YTD shipments at 12.6 MMT, down 36 percent. YTD corn export bookings (exports plus unshipped sales) now total 25.631 MMT, down 43 percent. With seven months left in the 2022/23 marketing year, U.S. corn export bookings account for 48 percent of USDA’s 48.9-MMT (1.925-billion bushel) export forecast.

The monthly Grain Crushings report from USDA noted that processors used 10.8 MMT (425.3 million bushels) of corn for fuel ethanol in December 2022, which was down 5.5 percent from November and down 11 percent year-over-year. Cold weather and icy conditions in the month hampered some operations and contributed to the declines. Corn used for industrial ethanol totaled 152 KMT (6.0 million bushels) and was down 25.8 percent from the prior year while corn for beverage ethanol totaled 112 KMT (4.4 million bushels) and was down 6.2 percent from December 2021.

Traders are looking forward to and starting to position for the February WASDE report, which USA will release on Wednesday, 8 February. The industry is generally expecting the agency to boost the Brazilian corn crop estimate and lower the Argentine crop outlook. Few changes are expected for the U.S. 2022/23 balance sheet beyond minor adjustments to exports or ethanol consumption of corn.