Chicago Board of Trade Market News

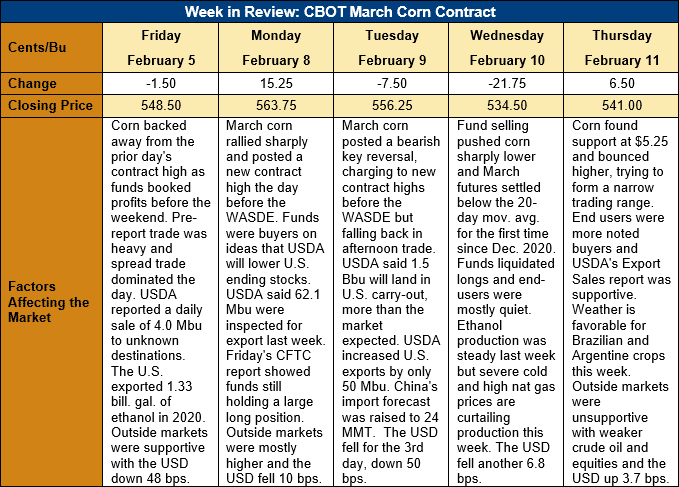

Outlook: March corn futures are 7 ½ cents (1.4 percent) lower this week after UDSA offered little bullish data in the February WASDE. Markets initially sold off sharply following the WASDE, but Thursday saw buying interest and profit taking emerge as prices neared technical support levels. The overall implication of the February WASDE is that bullish factors still exist, including potentially smaller crops in South America and a bigger U.S. export program, but USDA is waiting for these factors to fully develop before adjusting the U.S. and world balance sheets.

USDA made just three changes to the U.S. 2020/21 corn balance sheet: an increase in exports, a corresponding decrease in ending stocks, and a modest increase in its farm price. USDA increased its export forecast by 1.27 MMT (50 million bushels) to 66.043 MMT (2.6 billion bushels) and reduced ending stocks by the same amount. The agency’s ending stocks forecast now stand at 38.15 MMT (1.502 billion bushels), implying a 10.2 percent ending stocks-to-use ratio. The modest reduction in stocks prompted USDA to increased is farm price forecast to $169.28/MT ($4.30/bushel). The ending stocks forecast was on the high end of pre-report expectations, which gave the report a bearish feel.

USDA declined to make any adjustments to its forecasts of the Brazilian and Argentine corn crops, leaving them unchanged at 109 MMT and 47.5 MMT, respectively. Some analysts had predicted reductions in these crops based on poor weather conditions early in the growing season. In its Secretary’s Briefing, however, USDA noted it is still closely watching South American weather patterns and evaluating yield potential.

USDA revised its forecast of China’s corn imports sharply higher, with the latest forecast calling for 24 MMT of imports, up from 17.5 MMT last month. Despite the fact the UN FAO sharply lowered its estimate of China’s corn stocks earlier this month, USDA left its estimate mostly unchanged, revising 2020/21 ending stocks 4.5 MMT higher to 196.1 MMT.

U.S. exporters booked 1.448 MMT of net corn sales last week and exported 1.565 MMT. Exports were up 57 percent from the prior week and bring YTD exports to 21.5 MMT, up 82 percent. YTD bookings (unshipped sales plus exports) stand at 57.5 MMT, up 142 percent YTD. Exporters also recorded 110,000 MT of sorghum net sales and 54,900 MT of sorghum exports, bringing YTD bookings to 5.9 MMT, up 406 percent.

U.S. cash prices have remained relatively firm despite the futures market volatility. The U.S. average price hit $203.54/MT ($5.17/bushel) this week and basis narrowed slightly to 17 cents under March futures. Cash prices are down 3 percent from last week but up 42 percent from this time last year. Cold weather is making river navigation difficult and CIF NOLA offers for February and early March are becoming hard to find. FOB Gulf prices are slightly lower this week at $247.43/MT.

From a technical standpoint, March and May corn futures posted bearish key reversals on Tuesday, rallying to fresh contract highs before the WASDE was released but closing some 7 cents lower. The reversal sparked additional liquidation trade on Wednesday and early Thursday that carried the markets to key support levels. March corn found strong buying interest just below psychological support at $5.25 and rallied 6 ½ cents from there on Thursday. If Thursday’s support holds, the markets may enter a tight trading range with the contract high as resistance. If the markets continue to weaken, the major support levels are the 26 January daily low ($5.08 in March futures) and the 25 January daily low ($4.92 in March futures). Those levels, particularly the latter, are most likely to form the floor of what is increasingly expected to be a wide, volatile trading range.