Chicago Board of Trade Market News

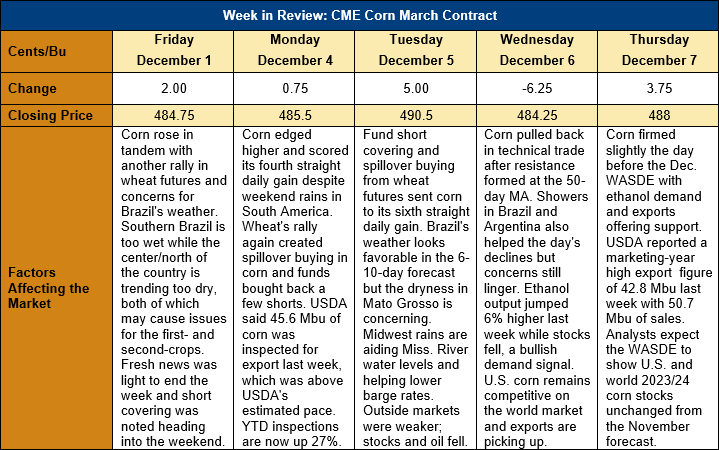

Outlook: Corn futures are 3 ¼ cents (0.7 percent) higher this week amid stronger demand, spillover support from wheat futures’ rally, and fund short covering heading into the December WASDE report. Fresh news was slow this week, as it often is during the months immediately following harvest, which means demand prospects are the primary driver of market price action. With U.S. domestic and export demand firming, corn futures look like they have forged seasonal lows and are now embarking on their annual grind higher.

U.S. corn exports are strengthening as the origin remains highly competitive on the world market and as the late-November dip in prices attracted international demand. Gross export sales totaled 1.309 MMT for the last week of November and exports rose 117 percent to 1.086 MMT – a marketing-year high. The export activity put YTD shipments at 8.7 MMT, up 30 percent, while YTD bookings (exports plus unshipped sales) now total 25.8 MMT, up 35 percent. Corn export bookings now account for 48.8 percent of USDA’s November WASDE 2023/24 export projection of 51.71 MMT.

Demand from the ethanol sector has also helped support the corn market as ethanol production and the weekly corn grind rose 6.4 percent last week. The industry used an estimated 2.769 MMT (109.0 million bushels) of corn for ethanol last week, which was 0.194 MMT (7.65 million bushels) above what was needed to keep pace with the USDA’s 2023/24 projection. Ethanol margins are historically strong despite declines over the past few weeks and are expected to remain high – and encourage greater corn use – heading into spring 2024.

Heading into the December WASDE that USDA will release on Friday, 8 December, analysts are expecting U.S. and world corn ending stocks forecast to remain essentially unchanged from November’s estimate. Analysts expect USDA to show U.S. 2023/24 corn ending stocks of 54.791 MMT (2.157 billion bushels), which would be up 25,400 MT (1 million bushels) from the prior month forecast. World 2023/24 corn ending stocks are expected to hit 299.2 MMT, which would be unchanged from USDA’s November report.

Technically, March corn futures are range-bound and trading sideways from support at $4.70 ½ (the 29 November daily low) to resistance at $4.96-5.00. Funds have covered some of their large short position over the past week with November’s price declines causing an uptick in U.S. domestic and export demand. Too, the wheat market’s export-driven rally has created spillover buying and support in corn futures. Normally, the corn market makes its seasonal lows in late October or early November and then strengthens from December to March or April. Those seasonal lows seem to have come later than usual this year, but this week’s price action indicates the seasonal rally may be already underway.