Chicago Board of Trade Market News

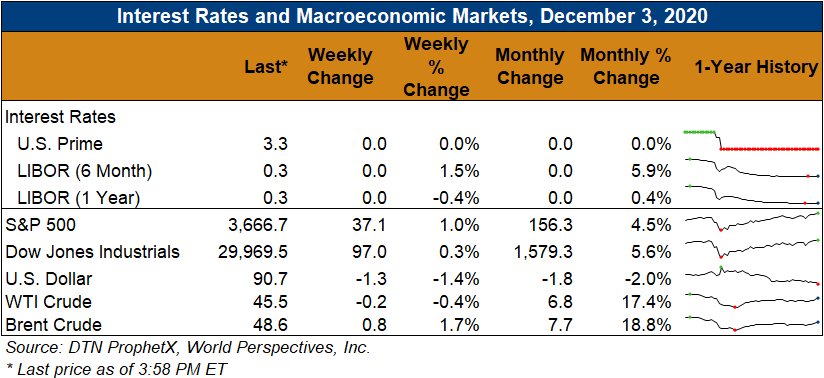

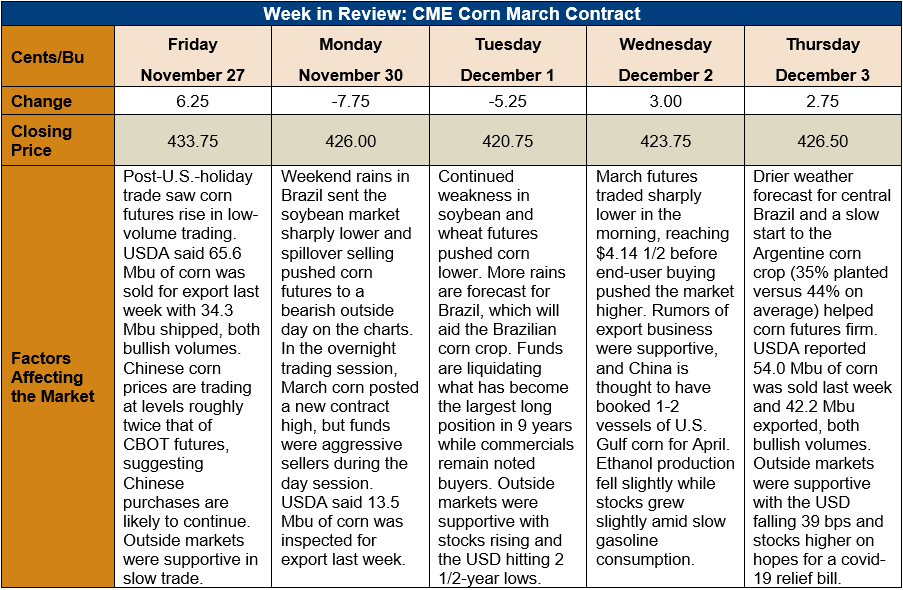

Outlook: March corn futures are 7 ¼ cents (1.7 percent) lower this week as a profit-taking and position-liquidation selloff Monday and Tuesday this week uncovered strong end-user and export demand on Wednesday and Thursday. Managed money funds were widespread sellers coming back from the U.S. Thanksgiving holiday week as they looked to book profits with CBOT futures turning sideways. Forecasts of rains for Brazil and Argentina helped pressure futures values as well as the La Nina-induced drought looks to be at least temporarily fading.

Weekend rains brought meaningful precipitation to northern Argentina and Southern Brazil that will aid corn and soybean crops in those regions. While Brazil’s primary crop-growing regions, including Mato Grosso, are still in a rainfall deficit, the 7-day forecast suggest 25-75 mm of cumulative precipitation for most of central and southern Brazil. While the forecasted rains will not be sufficient to end the drought, they will keep crops growing and avoid more serious yield losses. The more favorable weather outlook pressured CBOT soybean and corn futures this week as the market had priced in a significant weather premium.

With the U.S. corn and soybean harvests concluded for the year, the market’s attention is now solely focused on demand-side factors. The weekly Export Sales report from USDA showed 1.37 MMT of net export corn sales, down 18 percent from the prior week, due largely to the Thanksgiving holiday. Weekly exports increased 23 percent, however, totaling 1.07 MMT. YTD exports are up 63 percent at 10.37 MMT while YTD bookings (exports plus unshipped sales) are up 162 percent at 38.29 MMT.

While the futures market has corrected lower this week, the cash market remains strong with basis levels remaining well above year-ago values. The average basis for U.S. corn is 18 cents under March futures (-18H), up from -23H last week. Barge CIF NOLA offers are up 1 percent this week while FOB Gulf offers are steady at $222.50/MT.

From a technical standpoint, March corn futures look to be trying to define a new, sideways trading range. The market posted a bearish reversal on Monday by posting a new contract high during the overnight trading session and subsequently closing 7 ¾ cents lower. The market was weaker Tuesday and Wednesday morning before strong end-user buying near $4.14-4.15 pushed the market to a higher close on Wednesday. While not yet reflected in the USDA data, market sources suggest international buyers made significant purchases on Wednesday’s break. Now, March futures look to be establishing a trading range from $4.14 ½ to $4.39 ½ (the contract high) with $4.28 as a pivot point. Sideways trade is largely expected until the WASDE is issued next Thursday, December 10.