Ocean Freight Comments

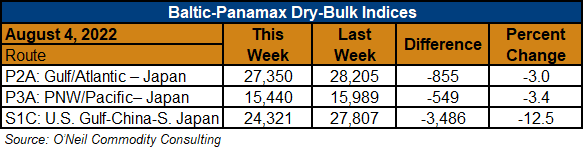

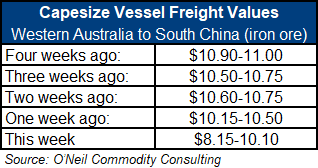

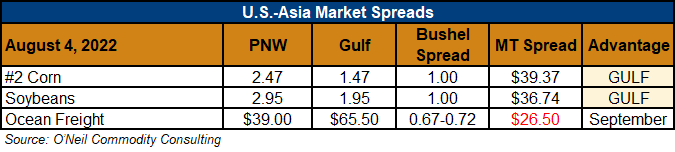

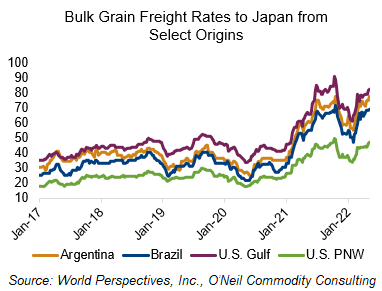

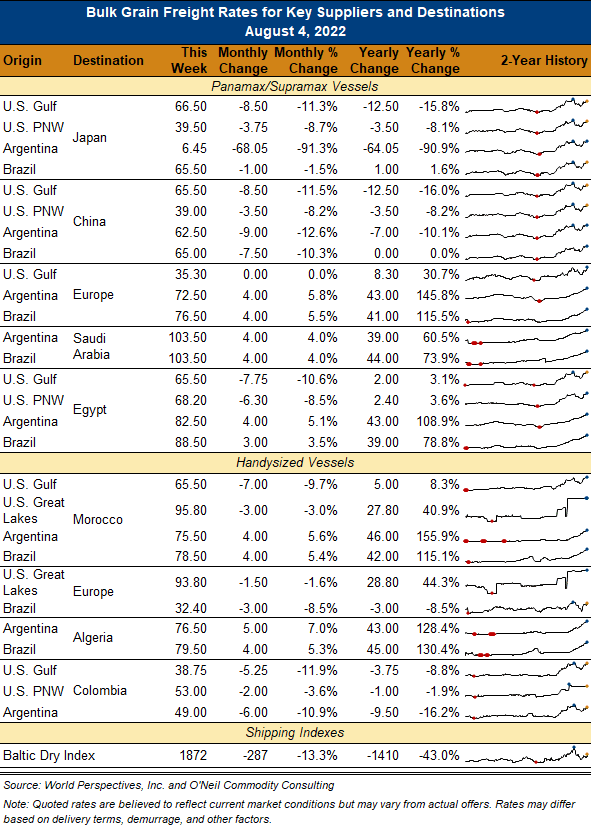

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: The title of this week’s report is “Looking for Buyers”. Dry-bulk markets started selling off at the beginning of June and by mid-July vessel owners and traders were asking if things had finally hit bottom. That question is still being asked each week as freight markets continue to drop back and show no mercy. There is nothing particularly new in terms of market news, just continued fear of reduced Chinese coal and iron ore imports and a lack of global cargo growth to support prices. On 26 May, Panamax rates from the U.S. Gulf to China were $81.50/MT but today they sit at $66.50/MT, a drop of $15.00 or 169 percent.

Values in the container markets are sliding back too. Multi-year contract rates are, of course, already fixed at higher values but spot rates are sinking even in face of growing port congestion.

The ILWU-West Coast Port labor contract negotiations continue as the big issue of port automation remains unresolved.