Chicago Board of Trade Market News

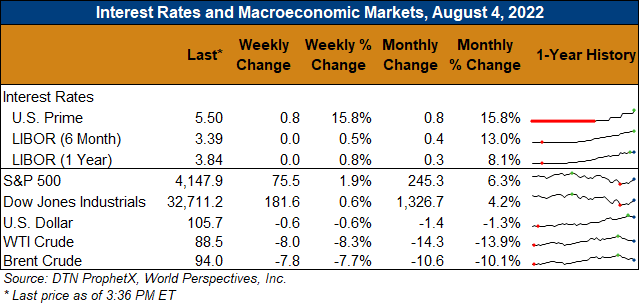

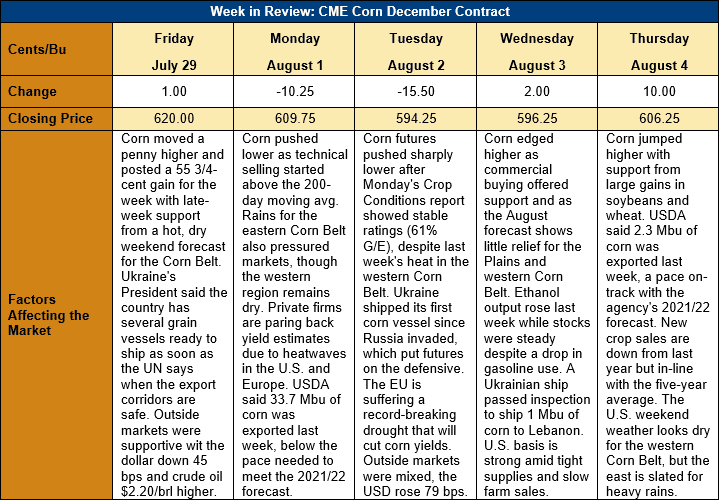

Outlook: December corn futures are down 13 ¾ cents (2.2 percent) this week as continued fund selling, and surprisingly good crop ratings pressured the market in early-week trade. News that Ukraine’s first grain shipments since the Russian invasion left the Port of Odessa on Monday also worked against world grain futures. Strength developed Wednesday and Thursday, however, on an uptick in commercial buying activity and an Export Sales report that put U.S. exports on track to meet USDA’s July WASDE forecast. Looking forward, weather and yield potential will be the key factors driving near-term market behavior.

The U.S. corn crop showed its resilience last week as conditions ratings were steady with the prior week, despite a heatwave across the western Corn Belt and Plains states. Sixty-one percent of the corn crop was rated good/excellent, which was 4 percent below the five-year average. Most of the crop has entered or passed though pollination with 80 percent of field silking (5 percent behind average) and 26 percent of the crop has entered the dough stage (6 percent behind average). The fact the corn crop survived the heatwave as well as it did was a surprise to the market and created early-week weakness in corn futures.

While the U.S. corn crop remains in average or better shape, the U.S. sorghum crop is suffering. Through Sunday, USDA estimated just 28 percent of the crop was rated good/excellent, down 2 percent from last week and well below last year’s 62 percent rating as of the same week. Forty-four percent of sorghum was headed, 10 percent behind last year, while 2 percent had entered the coloring stage, which is in-line with both 2021 and the five-year average for late July.

U.S. corn exports rose 18 percent last week to 1.021 MMT, which puts YTD bookings at 60.66 MMT, just even with USDA’s July WASDE projections. YTD exports lag USDA’s forecast by 7 percent with four weeks left in the marketing year. If this week’s export pace continues, however, the final export total will be very close to USDA’s expected 61-MMT export program. Notably, new crop export sales rose 33 percent from the prior week at 257,000 MT, which puts outstanding sales for the 2022/23 marketing year at 7.86 MMT, which is down from last year but in-line with the five-year average.

From a technical standpoint, December corn futures are in a wide trading range from support at $5.61 ¾ to recent resistance near $6.25. Funds continue to exit lingering long positions, but the effect of their position liquidation is diminishing. Moreover, the fact that the U.S. Midwest continues to see hot temperatures with little rain forecast for the western Corn Belt means yields in the region could disappoint and result in a late-season futures rally. Funds are aware of this and are reluctant to extend short positions, which has led to volatile, choppy trade. Between the heat in the U.S. Midwest and Europe’s record-breaking drought, it seems world corn markets are more likely to see fundamental support and edge higher than they are to break lower.