Ocean Freight Comments

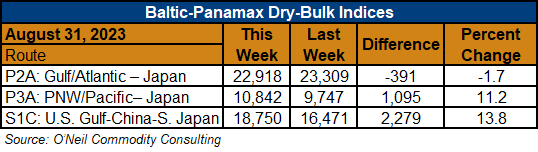

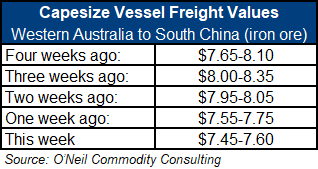

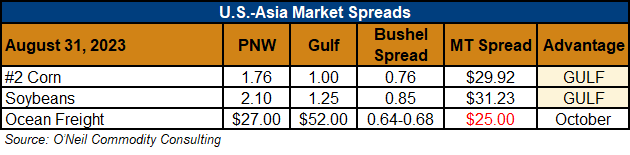

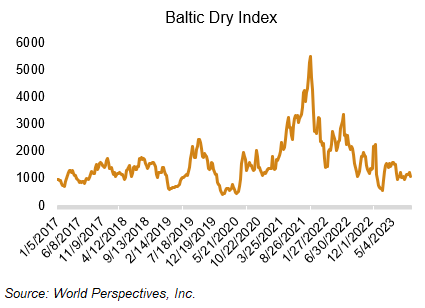

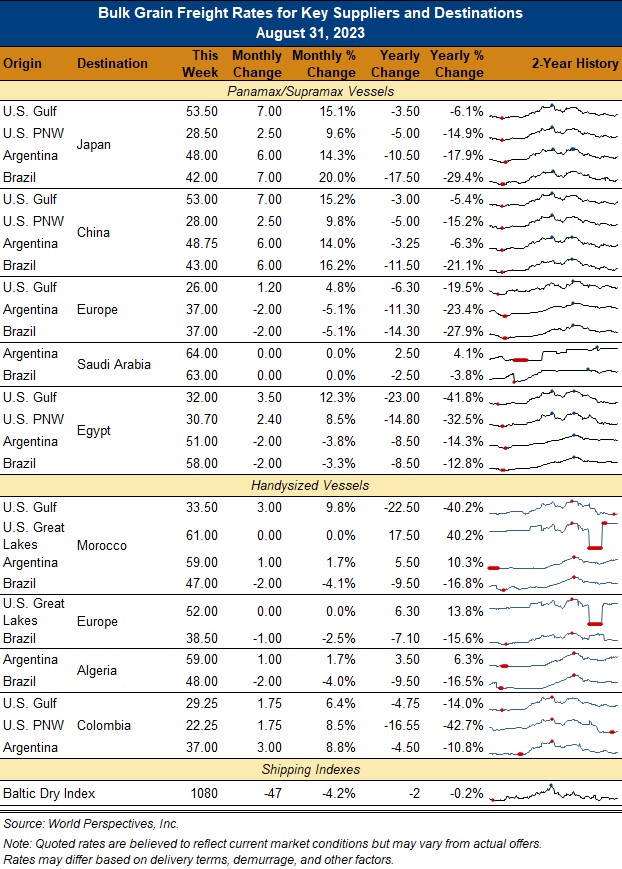

Transportation and Export Report: Jay O’Neil, O’Neil Commodity Consulting: Dry bulk markets continue to rise slightly one week and fall back the next. Rates have somewhat recovered from their June-July lows and have clawed their way back to the levels traded in March and April. Maybe that is progress? It is interesting that the recent market support has been led by the Panamax sector and not the Capesize market, as is most common. Dry bulk vessel profits, and stock prices, are suffering due to low-rate levels.

Container shipping markets are trying to answer the difficult question of: how do we survive? Post pandemic rates have dropped below operating cost and rate hikes are necessary, but too many new ships keep being delivered. There will likely be higher rates through the high holiday season, but it will be difficult, if not impossible, to maintain those rates into the new year.

September FFA Panamax markets traded at $12,600/day and Q4 is trading at $12,500/day with CY 2024 at $11,100/day. The Panama Canal still has a low water problem and container vessels must load lighter to meet the restricted draft requirements. Grain vessel wait times are running 10-12 days through the old locks.