Distiller’s Dried Grains with Solubles (DDGS)

DDGS Comments: DDGS values continue to grind sideways in unexciting trade with commodity futures pushing lower in advance of the new crop grain harvest. Ethanol production fell for the fourth time in five weeks despite strong production margins and the curtailed run rates are helping support DDGS values.

The DDGS/cash corn ratio is up sharply from the prior week at 1.17 and remains above the three-year average of 1.02. The DDGS/soymeal ratio is steady at 0.44 and below the three-year average of 0.50.

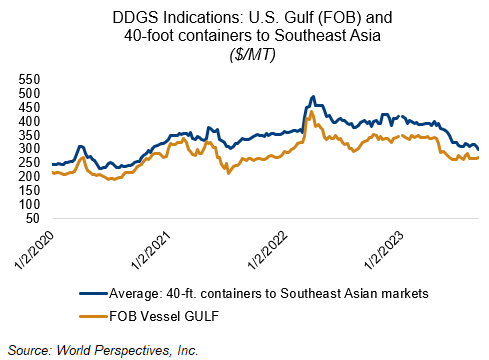

Rates for DDGS delivered by rail to key U.S. locations re up $3-4/MT this week as the ethanol co-product competes for space amid the new crop grain and oilseed harvest. Barge CIF NOLA DDGS offers higher this week with spot and Q4 rates up $4-5 as freight rates continue to rally on falling Mississippi River draft levels. FOB Gulf offers are commensurately higher with October offers up $6 at $272/MT and the forward curve remaining historically flat. Offers for 40-foot containers to Southeast Asia are down $11/MT at $300 for spot positions this week due to weaker ocean freight values.