Chicago Board of Trade Market News

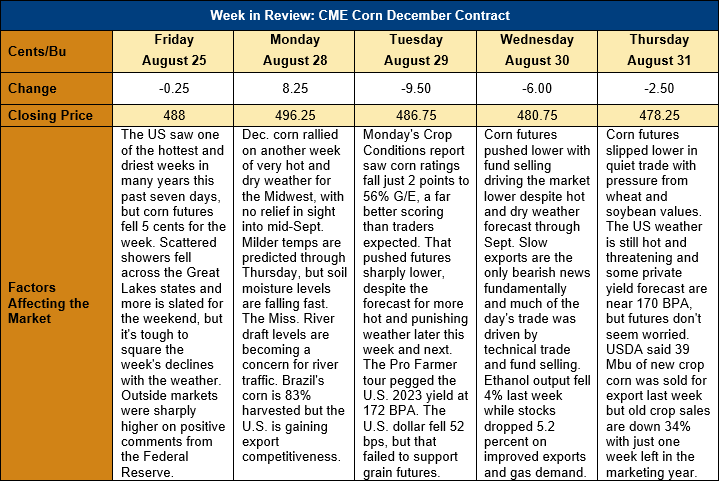

Outlook: Corn futures are 9 ¾ cents (2.0 percent) lower this week as managed money funds have been net sellers despite a hot and dry U.S. forecast into mid-September. The U.S. weather has been corn futures’ primary focus over the past two weeks as the major corn-growing states face several weeks of extreme temperatures and little rain. Soil moisture levels are falling while crop stress is increasing, hardly a positive combination for yields. Indeed, the Pro Farmer crop tour pegged the 2023 U.S. corn yield at 10.802 MT/ha (172.0 bushels per acre), below USDA’s August WASDE estimate of 10.996 MT/ha (175.1 BPA). Since then, some private analysts have published even lower yield estimates, which could take the 2023 crop down to 363.24 MMT (14.3 billion bushels) and 5 percent below USDA’s August WSDE projection.

One reason for futures’ decline in the face of hot, dry weather was the surprisingly positive ratings in Monday’s Crop Conditions report. USDA said the U.S. corn crop’s good/excellent (G/E) rating fell just 2 percentage points to 56 percent, despite the heatwave. That was well below analysts’ expectations of a 3-5-point drop and highlighted the resilience of the U.S. crop. Notably, Illinois’ crop ratings rose 3 points to 67 percent G/E and the Indiana crop rating rose 1 point to 67 percent G/E. The impact of the heatwave on the Western Corn Belt states, however, was obvious as Iowa’s conditions fell 6 points to 54 percent G/E and Nebraska’s ratings fell an equal amount. The market will closely be watching the next report to see if the cumulative impacts of two weeks of extreme heat will more dramatically decrease conditions.

The corn crop’s maturity remains in-line with the five-year average and 88 percent of the crop is in the dough states with 51 percent dented and 9 percent mature. All those metrics are within 2 points of their five-year average.

U.S. old crop exports continue to slow in-line with the normal seasonal pace, but new crop exports are accelerating. USDA said that 154 KMT of old crop corn was sold last week and 663 KMT was exported, putting YTD bookings for 2022/23 at 40.597 MMT (down 33 percent). With just one week left of USDA data that will be counted for the 2022/23 marketing year, YTD bookings account for 98.4 percent of USDA’s forecast, which suggests a minor downward revision may be coming in the next WASDE. New crop exports rose 47 percent from the prior week and hit 992 KMT, which put outstanding new crop sales at 8.344 KMT, down 15 percent from this time last year. Of note is the fact that China’s corn prices are valued near the equivalent of $376/MT ($9.55/bushel), which is about a $187/MT ($4.77/bushel) premium to U.S. futures. That suggests China may have interest and opportunities to expand its purchases of U.S. corn.